US$6.6 Billion In Twenty Years... 16 December Is 20th Anniversary For Resumption Of Direct Agricultural Commodity And Food Product Exports From United States To Cuba

/16 December Is 20th Anniversary For Resumption Of Direct Agricultural Commodity And Food Product Exports From United States To Cuba

First Contracts- Corn (ADM), Poultry (Louis Dreyfus), Rice (Riceland Foods)

December Deliveries- Corn (US$2,327,201.00) And Poultry (US$1,703,610.00)

More Than US$6.6 Billion Spent On “Cash-In-Advance” Basis

Cuba Averages Annually 48th Of 225+ Agricultural Commodity And Food Export Country Markets Measured By The United States Department Of Commerce.

Highest Ranking- 25th

Lowest Ranking- 63rd

Highest Year 2008- US$710.0 Million

Lowest Year 2002- US$138.6 Million

LINK To Detailed Export Data (2001 To Present)

26 September 2002 Is 20th Anniversary Of U.S.-Food & Agribusiness Exhibition With 923 U.S. Company Representatives Remains Largest Gathering Since 1959. Cuba Spent US$91.9 Million During The Event. LINK To Final Report

Signed into law by The Honorable William J. Clinton, President of the United States (1993-2001) and implemented by The Honorable George W. Bush, President of the United States (2001-2009), the Trade Sanctions Reform and Export Enhancement Act (TSREEA) of 2000 re-authorized the direct commercial (on a cash basis) export of food products (including branded food products) and agricultural commodities from the United States to the Republic of Cuba, irrespective of purpose.

Application of the TSREEA is under the auspice of the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury and Bureau of Industry and Security (BIS) of the United States Department of Commerce. The TSREEA does not include healthcare products, which remain authorized and regulated by the Cuban Democracy Act (CDA) of 1992.

The Following Is Reporting In November 2001 & December 2001 From The Economic Eye On Cuba As Published At The Time

On 14 November 2001, Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, presented a list of products (which has since been expanded) to be purchased from United States-based companies under provisions of the TSREEA. The government of the Republic of Cuba reported that the decision to purchase products from United States-based companies (and two United States-based subsidiaries of France-based companies) was due to the impact upon inventories from hurricane Michelle on 4 November 2001. Subsequently, the United States Department of State reported that the TSREEA licensing procedures would be expedited due to the humanitarian nature of the request from the government of the Republic of Cuba. Thus, while the reason(s) for the decision to purchase the products from United States-based companies (and a United States-based subsidiary of a France-based company) have a humanitarian component, the TSREEA authorizes the purchases regardless of a whether there exists a humanitarian component.

ADM FIRST U.S. COMPANY SINCE 1962 TO CONTRACT FOR DIRECT FOOD EXPORTS TO CUBA- On 20 November 2001, Decatur, Illinois-based Archer Daniels Midland Company (2000 revenues exceeded US$20 billion) signed the first contract since 1962 by a United States-based company for a direct sale of an agricultural product to a Republic of Cuba-based entity. Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, signed a contract with Archer Daniels Midland Company for 20,000 metric tons of Hard Red Winter Wheat for delivery from Texas to the Republic of Cuba in December 2001. ADM also contracted for 5,000 metric tons of long grain white rice (25% broken); 12,000 metric tons of soybeans (human consumption and for crushing); 6,000 metric tons of soybean oil; and 20,000 metric tons yellow corn for delivery in December 2001 and January 2002 through the Port of New Orleans, Louisiana, and the Port of Houston, Texas. Discussions are continuing for other products.

RICELAND FOODS OBTAINS CONTRACT FOR RICE EXPORTS TO CUBA- On 21 November 2001, Stuttgart, Arkansas-based Riceland Foods, Inc. (2000 revenues exceeded US$2 billion) signed a contract with Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, to export 15,000 metric tons of long grain white rice (25% broken) for delivery in December 2001 and January 2002 through the Port of New Orleans, Louisiana, to the Republic of Cuba.

FIRST COMMERCIAL CARGO TO CUBA IS CORN FROM IL, IN, IA, KS, KY, MN, MO, OH, WI- The first agricultural commodity cargo transported directly from the United States to the Republic of Cuba since 1963 will consist of 24,000 metric tons of corn from farms in Illinois, Indiana, Iowa, Kansas, Kentucky, Minnesota, Missouri, Ohio, and Wisconsin. Decatur, Illinois-based Archer Daniels Midland Company (2000 revenues US$20.1 billion) included corn from farms throughout the United States to reinforce the significance of the first shipment.

PORT IN LOUISIANA SELECTED TO LOAD FIRST COMMERCIAL CARGO TO CUBA SINCE 1963- Decatur, Illinois-based Archer Daniels Midland Company (2000 revenues US$20.1 billion) expects this week to commence the loading of 24,000 metric tons of corn which was contracted to Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba. The corn will be loaded and then transported to the Republic of Cuba from an Archer Daniels Midland Company-owned grain elevator facility located in Ama, Louisiana, approximately 30 minutes from New Orleans, Louisiana. The loading of the corn will take approximately 15 hours. The corn is scheduled to arrive at the Port of Havana approximately four days after departing Ama, Louisiana.

On 20 November 2001, Archer Daniels Midland Company signed the first contract since 1963 by a United States-based company for a direct sale of an agricultural product to a Republic of Cuba-based entity. Alimport signed a contract with Archer Daniels Midland Company for 20,000 metric tons of wheat for delivery from Texas to the Republic of Cuba; later amended to 30,000 metric tons of wheat. The wheat is being exported through a joint venture, ADM/Farmland Inc., established in 2001 between Archer Daniels Midland Company and Kansas City, Missouri-based Farmland Industries, Inc. (2000 revenues exceeded US$12 billion).

55.5 MILLION POUNDS OF CORN FROM ADM ARRIVES IN CUBA- On 16 December 2001, 24,000 metric tons (55,555,460 pounds) of corn (No. 2 and No. 3) with a market value of approximately US$2.5 million from Decatur, Illinois-based Archer Daniels Midland Company (2000 revenues US$20.1 billion) arrived at the Port of Havana aboard the 189.8 meter (622.7 feet), 50,000 metric ton deadweight, Singapore-registered bulk carrier M.V. Ikan Mazatlan, operated by Cuernavaca, Mexico-based PACNAV de Mexico S.A. de C.V. and owned by Cuernavaca, Mexico-based Mazatlan Shipping Pte Ltd. The M.V. Ikan Mazatlan departed from the Port of New Orleans, Louisiana, on 14 December 2001.

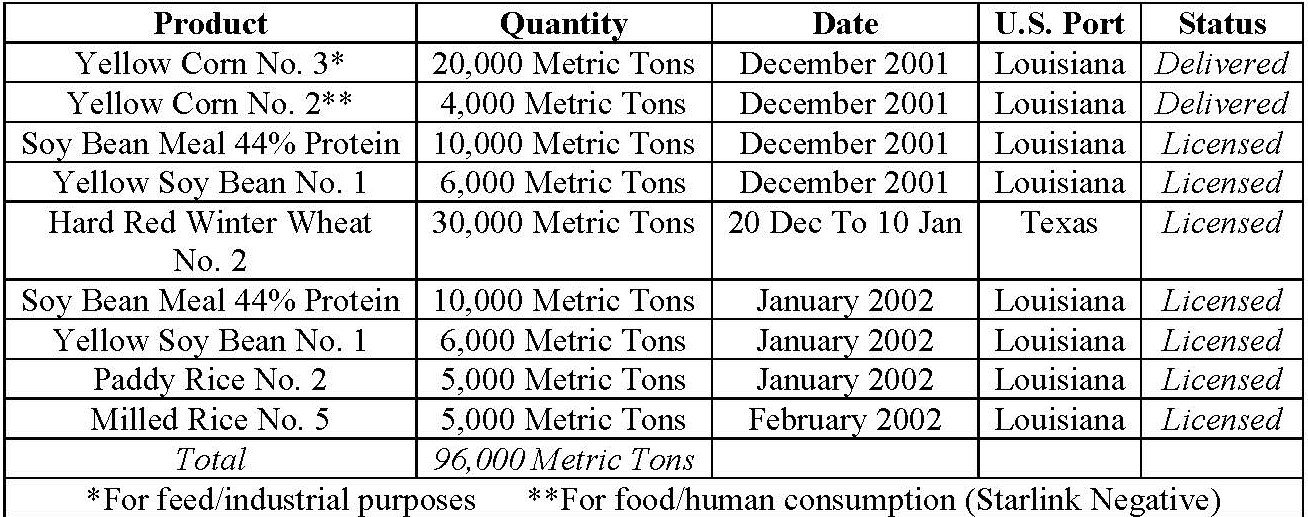

The corn represents the first direct commercial export of agricultural commodities from a United States-based company to the Republic of Cuba since 1963. The corn is from farms in Illinois, Indiana, Iowa, Kansas, Kentucky, Minnesota, Missouri, Ohio, and Wisconsin. The corn was sold to Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba. The total approximate market value (not contract value) of the products contracted by Archer Daniels Midland Company to Alimport since 20 November 2001 is approximately US$14 million, representing approximately 1.8% of the approximately US$750 million in purchases by Alimport in 2000. The current list:

POULTRY SOLD BY LOUIS DREYFUS CORPORATION OF FRANCE ARRIVES IN CUBA- On 16 December 2001, the M.V. Express container vessel arrived at the Port of Havana, Republic of Cuba, with refrigerated containers carrying 500 metric tons of frozen chicken leg quarters. The M.V. Express departed Gulfport, Mississippi, on 14 December 2001. The frozen chicken leg quarters were sold to Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, by Wilton, Connecticut-basd Louis Dreyfus Corporation, a subsidiary of Paris, France-based Louis Dreyfus Corporation (2000 revenues approximately US$27 billion).

An additional 2,000 metric tons of frozen chicken leg quarters sold to Alimport by Louis Dreyfus Corporation will be delivered to the Port of Havana during the week of 17 December 2001 aboard the 119.6 meter, Panama-registered Japan Star refrigerated cargo vessel. The Japan Star is owned by Athens, Greece-based Laskaridis Shipping Co. Ltd. Louis Dreyfus Negoce (a subsidiary of Louis Dreyfus Corporation) has a representative office located in the city of Havana, Republic of Cuba. Louis Dreyfus Corporation has offices in New York City, New York, and in Wilton, Connecticut; and the company is a partner in a joint venture that owns the 260-room Four Seasons Hotel in Washington, D.C.

Of the agricultural commodities (with a total market value of approximately US$30 million) contained in the list presented by Alimport to the United States Department of State on 14 November 2001, Louis Dreyfus Corporation has contracted to export from the United States the following products, with a total market value of approximately US$3.5 million: 2,500 metric tons of frozen chicken leg quarters (including the 500 metric tons delivered on 16 December 2001); 22,000 metric tons of corn; and 2,500 metric tons of rough (unmilled) rice. Reportedly, Alimport was requested to include Louis Dreyfus Corporation as a means to lessen unease expressed by current France-based suppliers to Alimport, especially as the government of the Republic of Cuba has substantial outstanding debt to France-based entities (government and private sector).

Alimport is purchasing approximately 6,000 metric tons of poultry (with a market value of approximately US$6.7 million) from the following companies: Louis Dreyfus Corporation; Atlanta, Georgia-based Gold Kist (2000 revenues exceeded US$1 billion); Arkansas-based Tyson Foods (2000 revenues exceeded US$7 billion); Salisbury, Maryland-based Perdue Farms (2000 revenues exceeded US$2 billion); Pittsburg, Texas-based Pilgrim’s Pride Corporation (2000 revenues exceeded US$2.2 billion); and Omaha, Nebraska-based ConAgra Foods, Inc. (2000 revenues exceeded US$27 billion).

5.51 MILLION POUNDS OF POULTRY FROM WEST VIRGINIA, ALABAMA, MISSISSIPPI, MARYLAND- On 20 December 2001, the 119.6 meter (392 foot), Panama-registered Japan Star refrigerated cargo vessel commenced loading at the Port of Pascagoula, Mississippi, with 2,500 metric tons (5,511,500 pounds) of frozen chicken leg quarters from Pittsburg, Texas-based Pilgrim’s Pride Corporation (2000 revenues exceeded US$2.2 billion) and Wilton, Connecticut-based Louis Dreyfus Corporation, a subsidiary of Paris, France-based Louis Dreyfus Corporation (2000 revenues approximately US$27 billion).

66.1 MILLION POUNDS OF WHEAT FROM KANSAS, OKLAHOMA, TEXAS- During the week of 7 January 2002, the first commercial shipment of wheat from the United States to the Republic of Cuba since 1963 will arrive at the Port of Havana. The 30,000 metric tons (66.138 million pounds) of Red Winter Wheat No. 2 from Kansas, Oklahoma, and Texas, will load at the Port of Galveston, Texas, on the 185.84 meter (609.7 foot) Panama, registered MV Sea Crown, chartered by Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba. The wheat is being exported to the Republic of Cuba through a joint venture, ADM/Farmland Inc., established in 2001 between Kansas City, Missouri-based Farmland Industries, Inc. (2000 revenues exceeded US$12 billion) and Decatur, Illinois-based Archer Daniels Midland Company (2000 revenues US$20.1 billion).

CARGILL OBTAINS CONTRACT FOR AGRICULTURAL PRODUCT EXPORTS TO CUBA- On 20 November 2001, Minneapolis, Minnesota-based Cargill Inc. (2000 revenues exceeded US$48 billion), signed a contract with Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, to export 20,000 metric tons of hard red winter wheat; 19,000 metric tons of yellow corn; and 5,000 metric tons of crude vegetable oil for delivery to the Republic of Cuba in January 2002 and February 2002.

ALIMPORT LISTS AGRICULTURAL COMMODITIES TO BE PUCHASED FROM U.S. COMPANIES- Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, is purchasing (on a cash basis) the following products, among others, with a total approximate current market value of approximately US$30 million, from United States-based companies (and at least one France-based company). The US$30 million represents 4% of the approximately US$750 million in food products and agricultural products purchased by Alimport in 2000 for use by the 11.2 million citizens of the Republic of Cuba. The government of the Republic of Cuba has continually reiterated that these purchases are a one-time series of commercial transactions under a humanitarian umbrella due to the 4 November 2001 impact of hurricane Michelle on inventories, and will not be repeated until there are changes in United States law governing commercial transactions between United States-based companies and Republic of Cuba-based entities. As of 21 November 2001, the total value of the products purchase thus far by Alimport is approximately US$20 million. H.E. Alejandro Roca, Minister of the Food Processing Industry of the Republic of Cuba, reported that due to the impact of hurricane Michelle on 4 November 2002, the government of the Republic of Cuba was required to immediately spend US$2.925 million to import flour and yeast due to damage to wheat mills and other facilities. Representatives of United States-based companies consider that accepting an “invitation” from Alimport to visit the Republic of Cuba is mandatory in order to be considered as a supplier for the purchases sought by Alimport.

CROWLEY LINER SERVICES LOWERS RATES FROM UNITED STATES TO CUBA- Seeking to expand current cargo market share, on 16 November 2001, Jacksonville, Florida-based Crowley Liner Services, a subsidiary of Oakland, California-based Crowley Maritime Corporation (2000 revenues approximately US$1.2 billion), announced implementation of a “humanitarian” pre-paid rate (no payment required by the exporter to a Republic of Cuba government-operated entity) for cargo authorized by the Bureau of Export Administration (BXA) of the United States Department of Commerce in Washington, D.C., and/or by the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury in Washington, D.C., from the United States through Mexico to the Republic of Cuba. The “humanitarian” rate may be used by exporters provided that a license (BXA and/or the OFAC) describing the cargo as “humanitarian” is presented to Crowley Liner Services.

Crowley Liner Services, among other United States-based companies, has authorization from the OFAC to provide regularly scheduled common carrier services between the United States and the Republic of Cuba for products authorized by the BXA and/or the OFAC. Crowley Liner Services currently operates the following routing: Port Everglades-Jacksonville-Havana-Progresso-Vera Cruz-Tampico-Progresso-Port Everglades; but the Port of Havana is not included at this time. The direct transit time from Port Everglades to Havana is three days.

Since receiving authorization from the OFAC to transport cargo directly from the United States to the Republic of Cuba, Crowley Liner Services has not been permitted by the government of the Republic of Cuba to operate direct service. However, cargo (humanitarian and commercial) from the United States has been transported by Crowley Liner Services to Vera Cruz, Mexico, where the cargo is transferred to vessels owned by Republic of Cuba government-operated Melfi Marine Corporation S.A. (a subsidiary of Republic of Cuba government-operated Corporacion Cimex S.A.) for the voyage to the Republic of Cuba. A representative of Crowley Liner Services visited the Republic of Cuba from 21 November 2001 to 23 November 2001 to discuss with Republic of Cuba government-operated Empresa Cubana Importadora de Alimentos (Alimport), under the auspice of the Ministry of Foreign Trade of the Republic of Cuba, the provision of direct cargo routings from the United States to the Republic of Cuba in conjunction with commercial exports by United States-based companies to Alimport, Republic of Cuba government-operated MediCuba (under the auspice of the Ministry of Public Health of the Republic of Cuba) and, perhaps, other Republic of Cuba government-operated entities. Alimport is seeking to have food products, agricultural products, and healthcare products delivered from the United States to the Republic of Cuba through ports (New Orleans, Houston, Alabama, etc.) located in those states which include United States-based companies, United States-based organizations, and Members of United States Congress who have sought to expand commercial, economic, and political relations between the United States and the Republic of Cuba.

Bureau Of National Affairs

Washington DC

26 November 2001

Agriculture Firms Sign First Farm Deals With Cuba In Almost Four Decades, Led by Giant ADM

By Chris Rugaber

Led by agribusiness giant Archer Daniels Midland, four U.S. companies have agreed to sell agricultural goods to Cuba, becoming the first U.S. companies to do so since 1962, business sources said Nov. 21.

John Kavulich, president of the U.S.-Cuba Trade and Economic Council, a nonpartisan business group, told BNA that representatives of ADM, Con Agra, Cargill, and Riceland were in Havana to sign agreements with Cuba's import agency, Alimport, Nov. 21. The sales are the first to be made under a sanctions reform provision included in last year's agriculture appropriations bill (P.L. 106-387). The provision permits the direct export of food and agricultural products to Cuba, subject to licensing requirements.

Proposal to Remove Ban on Private Financing

However, private and government financing of such exports are still banned. A proposal in the current Senate farm bill (S. 1628) would remove the ban on private financing, and may receive a political boost from the sales. A spokesman for ADM confirmed that his company reached an agreement on wheat and corn sales Nov. 20, and soy, soybean meal, and rice on Nov. 21, though he would not comment on the price or volume of the sales. Kavulich said that ADM agreed Nov. 20 to sell 20,000 metric tons of wheat with a market value of $2.5 million to Cuba. He added that the sales may not have been at market value, though all were profitable for the companies involved.

Kavulich also said that Cuba expressed interest Nov. 13 in purchasing approximately $30 million in agricultural, health, and construction products. The four agribusiness firms have captured most of the agricultural purchases, he said, which constitute about 80 percent of the requested $30 million. Three U.S. companies--Gold Kist of Georgia, Tyson Foods of Arkansas, and Perdue Farms of Maryland--were expected to win contracts for poultry exports, Kavulich added.

Previously, the government of Cuba refused to make any purchases under last year's law because of the remaining ban on government and private financing of such transactions. Cuba's Ministry of Foreign Affairs argued that this essentially left the embargo intact, and was "discriminatory and humiliating" to Cuba. Nevertheless, after Hurricane Michelle struck Cuba on Nov. 4, Cuban officials approached the United States Nov. 8 to request a temporary suspension of licensing requirements, and to seek permission to use Cuban vessels to transport the purchases, according to Kavulich.

The United States agreed only to speed the licensing process, he said, and noted that the use of Cuban vessels might prompt attempts by individuals with claims on the government of Cuba to seek a court-ordered seizure of the vessels. As a result, Cuba agreed to have the goods shipped on non-Cuban vessels. Cuba began soliciting bids from the U.S. companies Nov. 13, Kavulich said. Some of the U.S. companies began submitting licensing requests Nov. 16, while others will be submitted later the week of Nov. 18 and afterward, he said.

Political Impact

Kavulich noted that the purchase "demonstrates the political will and economic ability" of Cuba to purchase agriculture products. He also said it was a "shrewd move" that might influence the fate of Sen. Tom Harkin's (D-Iowa) farm bill (S. 1628), noting that Cuba approached the U.S. government Nov. 8, the day after the provision permitting private financing was approved by the Senate Agriculture Committee. Larry Cunningham, senior vice president for corporate affairs at ADM, was optimistic that the deal could have longer term consequences. "We think this is a breakthrough deal that we hope will lead to further sales to Cuba," he said. "We hope this will demonstrate to people that we're a nation with agricultural surpluses, only 90 miles" from an untapped market, he added.

Gannett News Service

Arlington, Virginia

26 November 2001

By Ana Radelat

American farmers are preparing to ship Cuba a mountain of wheat and thousands of tons of corn, soybeans and poultry - the first U.S. food sale to Cuba in nearly 40 years. U.S. farmers won an easing of the U.S. economic embargo in last year's agricultural appropriations bill.

Last week, representatives of Illinois-based Archer Daniels Midland, Minneapolis, Minn.-based Cargill Inc. and Stuttgart, Ark.-based Riceland Foods Inc., signed contracts in Havana to sell more than 100,000 metric tons of rice, wheat, soy, corn and soy meal and began negotiations to sell beans and cooking oil. Alimport, the Cuban state food import company, wants the commodities to be delivered by Dec. 10. ADM was the first to sign a contract with Alimport. The deal was for 20,000 metric tons of wheat, which has a market value of about $2.5 million. ``We've made history,'' ADM spokeswoman Karla Miller said.

Another three companies, Georgia-based Gold Kist, Arkansas-based Tyson Foods, and Maryland-based Perdue Farms, are likely to win some remaining Cuban contracts for 6,000 tons of frozen chicken leg quarters. Richard Loeb of the National Chicken Council said the poultry sale to Cuba would constitute a fraction of the year's exports for the industry -- which in the first nine months of the year reached 2 million tons. But he called the opening a "good sign." The U.S. agribusinesses involved in the sales declined to say how much Fidel Castro's government is paying for their commodities, but the U.S.-Cuba Trade and Economic Council estimates the total amount of purchases to be about $30 million.

Cuba decided to make the buy after rejecting a U.S. offer to send an aid team to assess the damage wrought by Hurricane Michelle, whose winds ravaged hundreds of thousands of acres of sugar cane and destroyed bananas, fruits and other crops Nov. 4. The purchase is possible because a U.S. law approved last year allows the sale of food to Cuba under certain conditions - including the requirement that Castro's government pay cash. Cuba chafed at the conditions and declared it would not buy ``a single grain of rice or aspirin'' until they were removed. But Castro was pressured to make the purchases because Cuba's food scarcities worsened when Michelle destroyed crops and livestock. ``We are ready, just for this once, to acquire certain quantities of food and medicine from the United States, paying them in cash,'' Castro said in a televised speech Nov. 16.

Havana initially wanted to ship the foodstuff in Cuban vessels. But when the Bush administration declined to bend the embargo's rules, Havana dropped its demands. The administration, however, said it would expedite the Bureau of Export Control licensing that is needed to complete the sales.

While some have hailed the Cuban decision to buy American goods as a new thaw in relations between Washington and Havana, U.S.-Cuba Trade and Economic Council President John Kavulich warned it may not happen again. ``U.S. businesses are treating these purchases as a one-time commercial sale under a humanitarian umbrella,'' he said. Nevertheless, farm lobbyists continue to press for better access to the Cuban market.

A provision that would remove the requirement that Cuba pay in cash for American farm products was included this month in a new $174 billion farm bill that the Senate is expected to consider soon. Championed by Senate Agriculture Committee Chairman Tom Harkin, D-Iowa, and other key farm state lawmakers, the measure would allow private U.S. financing of food sales - one of the restrictions placed on the new trade by embargo supporters in the House last year. The House has approved a similar bill that does not include the financing provision, making it one of several issues House and Senate negotiators will have to work out when they craft a final farm bill before Congress adjourns in December.

Dennis Hays, executive vice president of the pro-embargo Cuban-American National Foundation, said the organization is ``not crazy'' about the impending sales to Cuba, but would accept them because they're being carried out within the law and its restrictions. But the exile group opposes extending U.S. credit to Havana. Hays said Castro does not pay his bills. ``Everybody else who's done business on credit with Cuba has lived to regret it,'' he said.