Biden-Harris Administration Promotes Worldwide Use Of Electric Vehicles (EVs), But Denies BIS License To Maryland-Based Company Seeking To Export EVs & Chargers To Self-Employed And Micro, Small & Medium-Size Enterprises (MSMEs) In Cuba.

Trump-Pence Administration Permitted Electric Scooter Exports To Cuban Nationals And EV/Charger Exports To Embassies.

During Trump-Pence Administration, United States Embassy In Havana Sought Purchase Of EV. During Biden-Harris Administration, United States Department Of State Reports Purchase Unlikely Due To “impediments in the electrical infrastructure and lack of trained mechanics on the island” Really?

Given Their Respective Divergent Renewable Energy Policy Positions, Who Expected President Donald Trump Would Have Been More Facilitative Than President Joseph Biden On EV Exports To Cuba?

President Biden’s Staff To Cuba: We Don’t Trust You, So The Environment Can Suffer

BIS Regulations Suggest License Application Rejected Despite General Policy Of Approval For Items “related to renewable energy or energy efficiency.”

Did NSC Intervene To Force BIS To Act In Opposition To BIS General Policy Of Approval To Protect “International Air Quality”?

In a media statement directed to Republic of Cuba nationals on 20 May 2021, The Honorable Antony Blinken, United States Secretary of State, expressed United States support for Republic of Cuba entrepreneurs: “The United States recommits to accompanying the Cuban people in your quest to determine your own future. We will support those improving the lives of families and workers, cuentapropistas who have forged their own economic paths, and all who are building a better Cuba – and a better tomorrow for themselves in Cuba.”

Secretary Blinken was reiterating the bipartisan conviction of the Obama-Biden Administration (2009-2017), Trump-Pence Administration (2017-2021), and Biden-Harris Administration (2021- ) that the United States should “support the development of private business and [the] operation of economic activity in the non-state sector by self-employed individuals,” as that language is codified at 31 CFR § 515.570(g)(3).

From The Bureau of Industry and Security (BIS) of the United States Department of Commerce: “There is a general policy of denial for exports and reexports to Cuba of items subject to the EAR, as described in Section 746.2(b) of the EAR. However, there are exceptions to the general policy of denial, some of which are listed below: … Items necessary for the environmental protection of U.S. and international air quality, waters and coastlines, including items related to renewable energy or energy efficiency, are generally approved. A license exception is a general authorization to export or reexport certain items without a license under stated conditions. Only the license exceptions, or portions thereof, listed Section 746.2(a)(1) of the EAR are available for Cuba…. Support for the Cuban People: License Exception Support for the Cuban People (SCP) (Section 740.21 of the EAR) authorizes the export and reexport of certain items to Cuba that are intended to improve the living conditions, support independent economic activity, strengthen civil society, improve the free flow of information, and facilitate travel and commerce.” LINK

United States Department of State

Washington DC

3 December 2021

State Department spokesperson: “The Biden Administration has clearly articulated the United States’ goal to accelerate and deploy electric vehicles and charging stations, create good-paying, union jobs, and enable a clean transportation future to combat climate change. However, the United States Embassy in Cuba does not operate any electric vehicles nor has any solar power charging stations at our Embassy compound or residences in Havana. At this time, it would be unlikely that the United States Embassy consider importing one or more electric vehicles for use in Cuba in the near future due to impediments in the electrical infrastructure and lack of trained mechanics on the island to service electric vehicles.”

9 January 2017, Obama-Biden Administration Approved BIS License (valid until 31 January 2021) For Columbia, Maryland-based Premier Automotive Export, Ltd., To Export Nissan Leaf Electric Vehicle And Clipper Creek Level II 40 Amp Electric Charger With J-1772 Universal Charging Connector To Embassy Of Guyana In Havana, Republic Of Cuba. LINK

Embassy of Guyana

Havana, Republic of Cuba

17 March 2017

“OFFICIAL INVITATION LAUNCHING CEREMONY: NISSAN LEAF SUV FULLY ELECTRIC VEHICLE. The Embassy of the Cooperative Republic of Guyana and Cayman Automotive Limited are pleased to extend an Official Invitation to you to attend the Launching Ceremony of the First Fully Electric Vehicle in the Republic of Cuba Under the distinguished patronage of His Excellency Dr. Lancelot Cowie, Ambassador Extraordinary and Plenipotentiary of Trinidad and Tobago to the Republic of Cuba.” LINK

June 2017: United States Embassy in Havana, Republic of Cuba, requests information from Columbia, Maryland-based Premier Automotive Export, Ltd., for purchasing one electric vehicle.

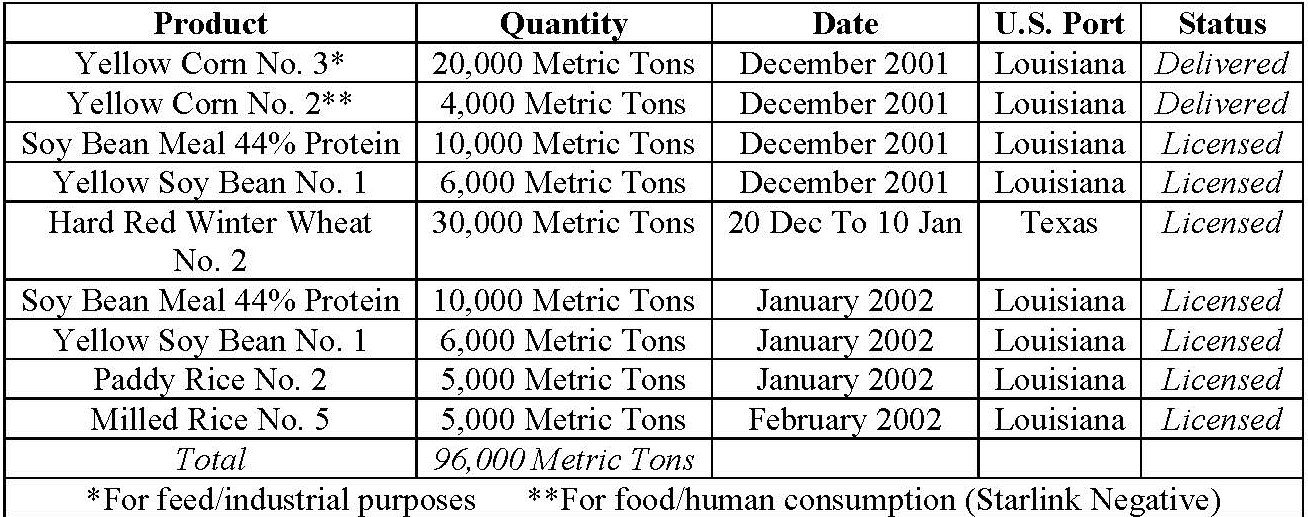

13 October 2017, Trump-Pence Administration Approved BIS License (valid until 31 October 2021) For Columbia, Maryland-based Premier Automotive Export, Ltd., To Export Electric Vehicles And Chargers To Embassies Cuba. BIS License Included Electric Vehicle Exports To United States Embassy In Havana, Republic of Cuba. Authorized Exports: 500- Electric-Powered Golf Carts (US$8,500,000.00); 100- Electric Charging Equipment For Hybrid Or Electric Powered Passenger Vehicles; (US$90,000.00); 25- Hybrid Of Electric-Powered Pickup Trucks (US$1,625,000.00); 500- Hybrid Or Electric-Powered Sedans (US$18,900,000.00); 500- Hybrid Or Electric-Powered Sport Utility Vehicles (SUVs) (US$26,300,000.00); 25- Hybrid Of Electric-Powered Minivans (US$1,200,000.00); 100- Hybrid Of Electric-Powered Hatchbacks (US$4,200,000.00); 150- Hybrid Or Electric-Powered Coupes (US$6,750,000.00); 5000- Electric Motorcycles And Scooters (US$7,500,000.00). “The items authorized by this license are for the exclusive use of the authorized diplomatic missions or their staff and households only…. Cuban nationals may not use the items unless they are doing so for official purposes of the diplomatic missions.” “All items shall remain in the possession of the authorized diplomatic missions or their staff and households at all times and must be destroyed (prior to their departure from Cuba) or removed from Cuba (upon their departure from Cuba) by the authorized diplomatic missions or their staff and households.” LINK

15 December 2021, Biden-Harris Administration Denied BIS License Application Of 30 September 2021 To Columbia, Maryland-based Premier Automotive Export, Ltd., To Export Electric Vehicles And Chargers To Republic Of Cuba Nationals, Registered Self-Employed, And Micro, Small & Medium-Size Enterprises (MSMEs). From License Application: “Specific End Use- Ordinary Cuban Nationals would be the specific End User and purchasing electric vehicle for their own personal transportation.” Inventory: 500- Nissan Leaf (US$17,500,000.00).

There is a BIS license exception authorizing the export of certain items to Republic of Cuba nationals. “§ 740.21 Support for the Cuban People (SCP). (a) Introduction. This License Exception authorizes certain exports and reexports to Cuba that are intended to support the Cuban people by improving their living conditions and supporting independent economic activity; strengthening civil society in Cuba; and improving the free flow of information to, from, and among the Cuban people. (b) Improving living conditions and supporting independent economic activity.…. (1) Items for use by the Cuban private sector for private sector economic activities… (2) Items sold directly to individuals in Cuba for their personal use or their immediate family's personal use,”

In 2017 and 2018 during Trump-Pence Administration, four (4) electric scooters exported by Columbia, Maryland-based Premier Automotive Export, Ltd., under provisions of a 13 October 2017 BIS license (valid to 31 October 2021) from the United States to the Republic of Cuba. For each transaction, BIS provided electronically with name of Republic of Cuba national end user, address and telephone number of end user, identification number for each end user, and certification that electric scooter did not exceed 1,000 watts.

United States Department of Commerce

Bureau of Industry and Security

Office of Nonproliferation and Treaty Compliance- Foreign Policy Division

Washington DC

10 November 2021

Columbia, Maryland-based Premier Automotive Export, Ltd., Application Date (30 September 2021). Referred to United States Department of State on 7 October 2021 and closed on 28 October 2021. Referred To United States Department of Defense On 4 November 2021.

“The Department of Commerce intends to deny the application referenced above. We are taking this action pursuant to Section 1756(a)(2) of the Export Control Reform Act of 2018 (ECRA) and in accordance with Part 750.6(a) of the Export Administration Regulations (EAR). The Department of Commerce believes that denial of this application furthers the United States policy in Section 1752(1)(B) of the ECRA, “to restrict the export of items if necessary to further significantly the foreign policy of the United States.” We have reviewed your license application to export electric vehicles to Empresa Logistica Palco for resale to the general population in Cuba. Interagency reviewers have determined that your proposed transaction would be detrimental to U.S. foreign policy interests due to an unacceptable risk of diversion to unauthorized end uses and/or end users that primarily generate revenue for the state (including uses in the tourism industry).”

“The attached application is rejected pursuant to Section 1756(a)(2) of the Export Control Reform Act of 2018 (ECRA), as amended, and paragraph 750.6 of the Export Administration Regulations. The U.S. Government has concluded that the export would be detrimental to U.S. foreign policy interests. Please refer to the attached official intent to deny letter dated November 10, 2021 for details regarding this denial. If you wish to rebut the intent to deny, a work item has been sent via SNAP-R that will allow you provide a rebuttal.”

United States Department of Commerce

Bureau of Industry and Security

Office of Nonproliferation and Treaty Compliance- Foreign Policy Division

Washington DC

15 December 2021

Columbia, Maryland-based Premier Automotive Export, Ltd., “This application [500- Nissan Leaf Electric Vehicle value US$17,500,000.00] is denied pursuant to Section 1756(a)(2) of the Export Control Reform Act of 2018 and Section 750.6 of the Export Administration Regulations. The Department of Commerce, in consultation with other U.S. Government agencies, has concluded that this export would be detrimental to U.S. foreign policy interests. Refer to the formal intent to deny letter for details regarding this denial.”

Electric Vehicles In Cuba

Amsterdam, Netherlands-based Stellantis N.V.-owned Sochaux, France-based Peugeot DTSR-171 electric vans (through Republic of Cuba-based distributor) and Yokohama, Japan-based Nissan Motor Co., Ltd., Nissan NV200e electric vans are using Type 1 (or Yazaki connector) SAE J-1772 standard charge plug.

Peugeot DTSR-171 electric van: “Has a high-efficiency motor that develops a power of 67 CV and allows it to reach a maximum speed of 110 km/h. Its lithium-ion battery has a capacity of 22.5 kWh and allows it to travel 170 km without recharging, a distance that meets the daily needs of most users of this type of vehicle. The charging time is between six and nine hours if using a normal charging point, although possible to achieve 80% of the charge in thirty minutes using a fast charger.”

Republic of Cuba government-operated companies Aguas de la Habana (with ten vehicles) and ETECSA use electric vans.

Cayman Compass

Cayman Islands

18 January 2017

Excerpts: The license stipulates shipment of “one 2015 Nissan Leaf, 100 percent electric four-door sedan with a range of 87 miles on a single charge. The engine is 24 kilowatts and delivers 97 horsepower,” and costs US$24,850.00. The document describes the station: “Clipper Creek level II charger is a 40-amp charger fitted with the J-1772 universal charging connector,” the same equipment used in Cayman’s charging stations. The license pegs the cost at US$875.00. Mr. Felder has been operating George Town-based Cayman Automotive since 2005, mostly trading in U.S., Japanese and Chinese trucks and cars. In 2009 he became Cayman’s sole electric-vehicle dealer, selling the first “EV” to Camana Bay and installing almost a dozen-and-a-half charging stations across Grand Cayman, supplying the 52 electric cars on the roads. The islands boast another 15 gas-electric hybrids. Guyanese Ambassador to Cuba Halim Majeed thanked Mr. Felder for the initiative: “On behalf of the Government of the Cooperative Republic of Guyana, and, indeed on my own behalf, I would wish to express our gratitude to you for your perseverance in exporting to my embassy a 100 percent electric vehicle,” the ambassador wrote on Jan. 10. Mr. Felder said he partnered with Advanced Solar Products, Inc., (https://www.advancedsolarproducts.com) based in Flemington, New Jersey, to install 50 charging locations, each costing approximately US$1,000.00, in gas stations across Havana. “They are going into Havana next month to get operating, and will be shipping chargers next month,” Mr. Felder said, indicating the company may employ Cuban-built solar panels. In a December 2014 issue of Cuba’s Granma International newspaper, Efren Marcos Espinosa, investment specialist at the Pinar del Rio electric company, said Cuba’s 4,000 solar panels each produced a peak output of 250 watts, saving approximately 8.4 million barrels of crude per year.

LINK TO COMPLETE SIX-PAGE ANALYSIS IN PDF FORMAT

Ministry of Transport of the Republic of Cuba (MINTRANS): Before 2030, MINTRANS plans for 45% of the total number of vehicles owned by Republic of Cuba government-operated companies will be electric vehicles. A goal is to introduce more than 56,000 electric vehicles of which about 36,000 will be imported while 17,000 will be retrofitted from existing combustion engine vehicles. A goal is to install 38,000 charging stations throughout the country with 16,000 fast charging stations and the remainder slow or semi-fast charging stations. An additional 2,000 slow and fast charging stations will in public places while 180 50KV fast charging stations will be located to supply public services. The first Cuban company to utilize electric vehicles in the Republic of Cuba was Republic of Cuba government-operated Aguas de la Habana. The company operates a twenty-two Nissan e-NV200 vehicles. LINK To YouTube Video: https://www.youtube.com/watch?v=uNhxN0aevXc