Cuba Has 1.42% Shareholding In Hungary-Based International Investment Bank

/International Investment Bank (IIB)

Republic of Cuba Governor Of IIB

Mrs. Marta Sabina Wilson Gonzalez

Minister-President

Central Bank of Cuba

Havana, Republic of Cuba

As of 1 August 2020, the Republic of Cuba had a 1.42% share (5.361 million Euros) of Budapest, Hungary-based International Investment Bank (IIB), “a multilateral development institution” crafted by Russian Federation-based interests, compared with 1.6% as of 31 December 2018, 1.7% as of 31 December 2017, 1.713% (5.4 million Euros) as of 31 December 2016, and 1.769% as of 31 December 2015. The total paid-in capital of IIB was 313.1 million Euros as of 31 December 2016 compared with 748.7 million Euros as of 1 August 2020. As of 1 August 2020, the Republic of Cuba represented 4% of the IIB net loan portfolio.

LINKS

2020 Investor Presentation

2019 Annual Report (not available)

2018 Annual Report

2017 Annual Report

2016 Annual Report

From 2018 Annual Report

Technical Assistance Fund (ongoing projects): The main purpose of the Technical Assistance Fund (TAF) is to finance the provision of advisory services and technical assistance on the projects financed, or to be financed by IIB within its mandate. The target countries include Mongolia, Vietnam and Cuba.

Client: Proxenta Cuban Investments, a.s. Country: Cuba Project description: the goal of the project is to provide technical expertise including: (1) verifying the assumptions of the project preparation and implementation; (2) obtaining knowledge about the market conditions, legal environment, risks, and regulation in Cuba; and (3) developing relevant project documentation. The project started in October 2018 and is expected to be completed in February 2019. Consultant: Ernst & Young, s.r.o. Budget: EUR 91,745.00

As of 31 December 2018, the Republic of Cuba (Proxenta Cuban Investments, a.s.) owed the IIB approximately 49.4 million Euros, representing approximately 7% of IBB loans then outstanding.

From 2016 Annual Report

We expect a substantial impact from developing direct cooperation with Cuba. In the past year, the IIB approved the first Cuban project- a loan to Banco International de Comercio SA (BICSA). The funds are to be used for financing imports to Cuba from IIB member states and joint ventures between the Republic and companies from IIB member states.

At the business forum Supporting Economic Growth in Hungary and the CEE Region, held during the 105th Meeting of the IIB Council in Budapest, the IIB and the Central Bank of Cuba signed the Agreement on Cooperation in the Arrangement of Financing providing for guarantees to be issued by the Central Bank of Cuba for IIB’s projects and programs in Cuba. In this context, the IIB approved its first Cuban project, as part of a two-tier financing structure. The borrower, Banco International de Comercio SA (BICSA), will receive EUR 30 million for the purpose of financing imports to Cuba from IIB member states and support to joint ventures between Cuba and IIB member states.

The deal with Sberbank CZ, A.S. (funding Czech exports to Cuba) became the pilot project within the country limit for Cuba as established by the Bank: IIB took over the risks from Cuba’s BICSA, by whose instruction an irrevocable reimbursement undertaking.

As of 31 December 2016, IIB has Term deposits (amounts due to IIB) with the National Bank of the Republic of Cuba without credit rating of 34,967 Euros less an allowance for impairment of 34,967 Euros.

Who Is The IIB

What is IIB? International Investment Bank (IIB) is a multilateral development institution with headquarters in Budapest, Hungary. It was established in 1970 and operates as an international organisation based on the intergovernmental Agreement Establishing the International Investment Bank dated 10 June 1970, registered with the United Nations Secretariat on 1 December 1971 under number 11417, as amended and restated from time to time. The IIB’s mission is to facilitate connectivity and integration between the economies of the Bank’s member states in order to ensure sustainable and inclusive growth and the competitiveness of national economies, backed by the existing historical ties. IIB specialises in medium- and long-term financing of projects aimed at supporting the economies of its members that would have a significant positive social, economic and environmental impact. The Bank offers direct financing and provides loans in partnership with other financial institutions as well as through partner banks.

Who are members of IIB? The following countries are the Bank’s members: the Republic of Bulgaria, the Republic of Cuba, the Czech Republic, Hungary, Mongolia, Romania, the Russian Federation, the Slovak Republic and the Socialist Republic of Vietnam.

In which countries does IIB operate? IIB operates in its member states and can also finance projects in other countries, if the implementation of such projects would have a significant positive impact on the Bank’s members.

How does IIB differ from a commercial bank? IIB is an international financial organisation. Its goal is to promote the economic development of the member states, develop export and import operations, and stimulate trade and economic ties between them. Unlike commercial banks, making profit is not the Bank’s main priority. As an international organisation, the Bank is not subject to national banking and other regulations; it enjoys immunities and privileges and inter alia is exempt from paying taxes on the territories of its member states. The IIB’s activities are regulated by the Bank’s statutory documents, namely, the Agreement Establishing the International Investment Bank dated 10 June 1970, registered with the United Nations Secretariat on 1 December 1971 under number 11417, as amended and restated from time to time, together with the Bank’s Charter, which is an integral part of the Agreement, that constitutes an international treaty, bilateral agreements between the Bank and the member states, applicable international law, as well as other regulatory documents of the Bank.

Where is IIB located? The IIB’s headquarters is located in Budapest, Hungary. IIB has a branch in the Russian Federation, in Moscow.

Who is the head of IIB? The Chairperson of the Management Board, Mr Nikolay Kosov, has managed IIB since 2012.

Who can become a member of IIB? A distinguishing characteristic of IIB as an international organisation is its supranational status. The Bank has members from Asia, Europe and Latin America. International financial institutions from other countries that share the IIB’s aims and operating principles and assume the obligations arising out of the Agreement Establishing the IIB may be accepted as members of the Bank. New members of the Bank shall be accepted upon a resolution of the Board of Governors.

Are there other forms of participation in the activities of IIB? States, international financial institutions, banking, economic and financial organisations and funds that share the IIB’s mission, aims, values and objectives may participate in the IIB’s activities as an associate member, associate partner or observer.

Management structure of IIB The Board of Governors is the Bank’s supreme collective governing body, consisting of representatives from the IIB’s member states. The Board of Directors is responsible for the general management of the Bank. The Bank’s executive body is the Management Board, whose members are appointed by the Board of Governors. The Bank’s activities are controlled by the Audit Committee, which is made up of representatives from the IIB’s member states appointed by the Board of Governors. The Bank’s financial statements are confirmed by a half-year compliance audit review and an annual audit conducted by international auditors EY.

What are the advantages of working with IIB? The Bank’s intergovernmental status and solid support from the public authorities of the member states; Wide geographical presence: IIB operates in EU countries and the Asian market; A tailor-made approach to deals and projects, considering regional specifics as well as integration projects between the member states; Flexibility in terms of financing terms and conditions; Priority participation in implementation of the Bank’s projects.

How to apply for IIB financing? Customer Relations Department; Tel.: + 36 1 727 89 11, +7 495 604 7416, e-mail: credit@iibbank.com

Who can become a client of IIB? Corporate clients and financial organisations that share the IIB’s principles and priorities and that meet the IIB’s general requirements and financial criteria, including: corporate clients, whose activities provide added value and ensure sustainable development of the member states, and who are implementing investment projects on the territories of the member states; international financial institutions; national development banks; banks with state ownership and /or ownership by national and international development banks; commercial banks focused on financing key areas of the economy in the member states and which are leading players in regional markets; leasing companies that lease products to key sectors of the economy in the member states; funds whose activities comply with the IIB’s principles and priorities.

Which projects does IIB not finance? Projects that do not promote the sustainable development of the IIB’s member states; Projects that do not comply with the Bank’s strategy, mission and priorities or that involve illegal practices.

What is the IIB’s policy regarding corporate social responsibility? IIB is guided by the principles of corporate social responsibility (CSR), which enable the Bank to effectively respond to the challenges of an international development institution. By giving priority to the financing of socially oriented, energy- and resource-efficient projects, IIB is pursuing the goals of sustainable development. This serves the national interests of the member states and promotes a high quality of life for their citizens. The Bank’s activities are aimed at helping to improve the environment and mitigate the impact of climate change. The Bank’s aims, objectives and priority areas are determined by the Corporate Social Responsibility Policy, approved by the IIB Management Board.

How to report corruption, fraud or other offenses? The Bank operates in accordance with the international compliance standards (FATF, Basel Committee on Banking Supervision, OECD). According to the Procedure for Receiving and Handling Complaints in IIB, any person can contact IIB to report suspected or actual offenses associated with the activities of IIB. Such reports may concern corruption, fraud and money laundering by IIB or by its employees and counterparties. Complaints can be sent to IIB through the following channels: By post to IIB marked “for the attention of the Compliance Department”; By email to compliance@iibbank.com; Using the online form Report abuse.

Who regulates the Bank’s activities and which standards does it observe? The Bank’s operations shall be governed by the Agreement Establishing the IIB, bilateral agreements between the Bank and the member states, as well as applicable international law. In accordance with Article 12 of the Agreement Establishing the International Investment Bank dated 10 July 1970, registered with the United Nations Secretariat on 1 December 1971 under number 11417, as amended and restated from time to time, the Bank’s activities are regulated by the above Agreement and the Bank’s Charter, which is an integral part of the Agreement, as well as other regulatory documents of the Bank. Based on the supranational nature of its legal personality, the Bank adheres to universally accepted principles and standards of international law.

IIB top management held a working meeting with representatives of the international audit and consulting company EY (22 May 2019)

On May 21, 2019, IIB top management held a working meeting with representatives of the international audit and consulting company EY, which was appointed as the Bank's auditor as a result of an international tender procedure. The company presented managers of EY Hungary, who will carry out ongoing cooperation with IIB after the relocation of the Bank’s headquarters from Moscow to Budapest.

The IIB Chairperson of the Management Board Nikolay Kosov addressed the audience with a welcoming speech. He briefly described the progress of the implementation of the IIB “Growth Strategy” for 2018-2022, stressing that the Bank shows impressive performance in all key areas of activity and is developing ahead of plans agreed by the member states. Deputy Chairpersons of the Management Board also made brief presentations on the areas of their responsibility, presenting heads of key departments. EY auditors gave a high assessment to the reform and current performance of International Investment Bank, emphasizing the long-term positive effect of the decision of the member states to relocate IIB headquarters to Europe. The parties noted with satisfaction the high level and effectiveness of joint work and expressed confidence in further fruitful cooperation between IIB and EY.

High-level dialogue with Cuba (6 November 2018)

As part of the official visit to the Russian Federation the Chairman of the State Council and the Council of Ministers of the Republic of Cuba, Miguel Mario Díaz-Canel-Bermudes and key members of the Council of Ministers held a business meeting with leaders of major companies and financial institutions that implement strategic projects in Cuba. International Investment Bank (IIB) was represented by the Acting Chairman of the Management Board Georgy Potapov.

Addressing the audience, Mr. Mikel Mario Díaz-Canel-Bermudez noted the great importance the country gives to attracting investment to local economy, stressed the fundamental role of foreign, in particular, Russian business participation in the context of a modernization program of the country's economic system aimed at further increase of its industrial and financial potential.

Mr. Potapov in his speech expressed appreciation for the support provided to IIB, both in the search for new and in the implementation of projects already funded by the Bank in Cuba. “IIB remains the only multilateral development bank with Cuba as a shareholder, which currently supports the country's economy through providing funds to Cuban financial institutions,” Georgy Potapov said, “the trade finance portfolio aimed at assistance of Cuban exports already exceeds 21 million euros, and is constantly growing. At present, IIB is considering its participation in several significant initiatives in the country, including major infrastructure projects.”

IIB Acting Chairman of the Management Board also noted that in December this year, Cuba would host the inaugural meeting of the IIB Board of Governors, the first one since ratification of the new version of the Bank’s statutory documents, where strategically important decisions for IIB’s further development will be made. In the framework of the dialogue, the participants of the meeting discussed a wide range of issues related to further expansion of economic interaction of Cuban enterprises with the leaders of Russian and international business, outlined specific steps for their practical implementation.

Cuban direction: IIB charts route on location (3 November 2017)

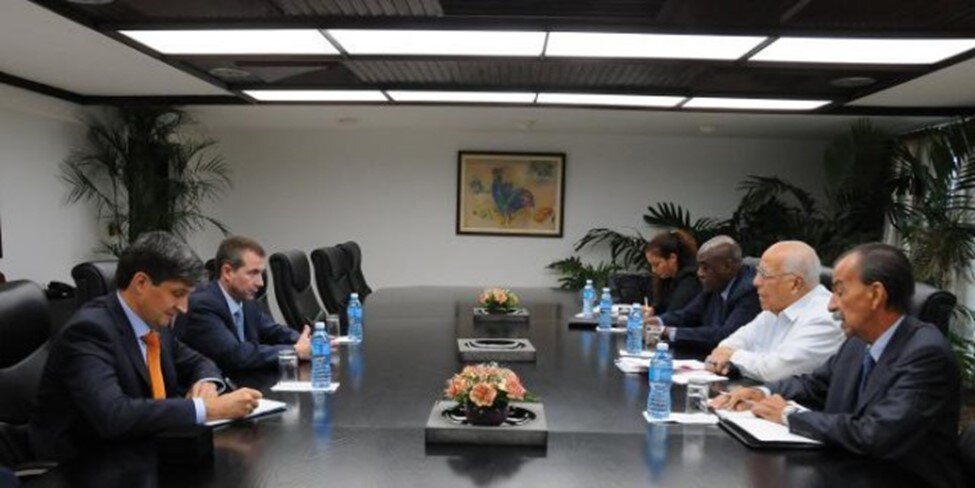

The implementation of projects involving Cuban companies and building of a potential for investment activity of the International Investment Bank (IIB) in Cuba was the main topic during the IIB’s working visit to Havana that took place on October 30 – November 2, 2017.

The Bank’s delegation held a series of meetings and negotiations with high-ranking representatives of the Cuban government, and also with the CEOs of major Cuban banks, financial institutions, and investors from the IIB member states.

The IIB granted credit facilities to leading Cuban banks this year, including the Banco Exterior de Cuba (BEC) and Banco Internacional de Comercio S.A. (BICSA), worth EUR 20 million and 30 million, respectively.During the visit, the BICSA President Mr. José Lázaro Alari Martínez and chief investment officer of BEC, Mrs. Elvia Graveran Pacheco, welcomed the IIB delegation and discussed ways how to promote cooperation. The parties discussed the implementation of previous deals with a view of expanding portfolio of export-import transactions between the IIB member states and Cuba, as well as setting up and funding joint ventures. During the negotiations, a number of technical issues were also examined, including those relevant to current and future lending cooperation.

The meeting between the head of the IIB delegation, Deputy Chairman of the Board Denis Ivanov and Vice President of the Council of Ministers of Cuba, Mr. Ricardo Cabrisas Ruiz, was used to explore the possibility of investment support for the construction, energy and processing sectors of the national economy. The meeting touched upon the implementation of large-scale infrastructure projects on the island, and further steps in lending to the banking sector.Mr Ruíz stressed that Cuba is interested in more active use of the IIB resources, including the funding of strategic and priority projects as part of the Programme of Socio-Economic Development of Cuba until 2030. He noted the importance of increased funding for foreign trade operations and development projects involving Cuban companies. The Bank’s representatives also held negotiations with the Vice-President of the Central Bank of Cuba and head of the Cuban delegation to the IIB Council, Mr. Arnaldo Alayón Bazo.Business issues under current agreements were also discussed, as well as the outlook for future development of the entire range of mutually beneficial cooperation.

As follow up of the visit additional information was requested for the investment support of a number of projects submitted to the IIB by the Embassy of the Republic of Cuba to the Russian Federation. The Bank expressed its interest in the construction project looking forward to expand the Havana Airport. The conditions were clarified for the formation of a joint venture by the Slovak company Proxenta with the Cuban government on producing confectionery products. Under this venture, the Slovak party would be keen to receive the IIB funding. As part of the visit, the IIB also participated in events related to the 35th Havana International Fair (FIHAV 2017), which was attended by the investors from the IIB member states and which turned out to be a great success.

Government delegation of the Republic of Cuba visited headquarters of the IIB (13 July 2017)

On July 12, 2017, the delegation of the Republic of Cuba, led by the Minister of Construction, Mr. René Mesa Villafaña, payed a working visit to the headquarters of the International Investment Bank (IIB). During the meeting, the members of the IIB Board discussed with the Cuban partners a wide range of issues concerning the investment cooperation and the comprehensive expansion of the Cuban direction of the Bank’s activities.

The delegation also included the Ambassador Extraordinary and Plenipotentiary of the Republic of Cuba to the Russian Federation, Mr. Emilio Lozada Garcia, the Head of the Secretariat of the Minister, Mr. Ariel Pérez Ruiz, and other Cuban officials. The parties discussed both the existing opportunities for the IIB to promote the sustainable development of the Cuban economy and economic cooperation of the member states, and the specific options to support the institution’s activities by its shareholders in the context of the Bank's Development Strategy for the period 2018-2022.

The Deputy Chairman of the IIB Board, Jozef Kollár, presented an overview of the Bank's existing projects, related to Cuba, including under the Trade Finance Support Programme, and highlighted the activities of the Fund for Technical Support, managed by the IIB. He noted the importance to finance the programmes and to support the export-import operations that promote economic cooperation between the Republic of Cuba and other member states of the Bank.

Whereas, Mr. René Mesa Villafaña, stressed Cuba's interest to attract foreign capital and marked a number of development projects for investments at the territory of the island. The Minister expressed hope for their implementation with the active use of resources provided by the IIB.

During the past several years, the Cuban direction of the Bank’s activities has seen substantial positive developments. The Bank is the only multilateral development institution with Cuba as a member and effectively carries the status of a special creditor for the Republic. In 2016, the IIB signing of Memoranda on Cooperation with leading Cuban banks – Banco Exterior de Cuba (BEC) and Banco Internacional de Comercio S.A. (BICSA) and the Agreement on Cooperation the IIB and the Chamber of Commerce of the Republic of Cuba; and the pipeline includes a number of future deals.

EUR 50 million in credit lines anticipated after signing of documents at IIB Day in Cuba (7 November 2016)

On November 3, 2016, at the so-called IIB Day during the Havana International Fair, Deputy Chairman of the IIB Board, Vladimir Liventsev, gave a detailed presentation of the financial instruments of the Bank for supporting sustainable development projects in the country, emphasizing export/import and financing of SPVs set up jointly with companies from other IIB member states. In contrast with the past four years, when the renewed Bank supported the Cuban economy only indirectly, by financing its trade partners in the total amount of around EUR 50 million, today the IIB is ready to work directly on the Caribbean’s largest island.

As a testimony, the event included the signing of Memoranda on Cooperation with leading Cuban banks – Banco Exterior de Cuba (BEC) and Banco Internacional de Comercio S.A. (BICSA), represented by their presidents, Manuel A. Vale Marrero and José Lázaro Alari Martínez. The subject of these documents is the support for, on one hand, Cuba’s trade with other member countries of the Bank and, on the other hand, development of joint ventures with foreign investors. Even more importantly, these memoranda shall bring a practical result already in the near future in the form of the anticipated signing of agreements, under which the IIB will provide BEC (EUR 20m) and BICSA (EUR 30m) with credit lines for a total of EUR 50 million.

In addition, institutionalising relations between the IIB and the Chamber of Commerce of the Republic of Cuba, which provided significant support to the Bank in organising the IIB Day, on November 4 the parties concluded an Agreement on Cooperation to further develop their partnership and exchange of information between them with the aim of expanding collaboration in the area of trade and investments.

Thus, the Cuban direction of the Bank’s activities has seen substantial positive developments during the past several years, on the background of geopolitical shifts around the island country. Today, the IIB as the only multilateral development institution with Cuba as a member effectively carries the status of a special creditor for the Republic, as confirmed by the Agreement on Cooperation in Organising Financing, signed between the IIB and the Central Bank of Cuba in June this year and guaranteeing the Bank’s activities on the island.

IIB signs cooperation agreement with Central Bank of Cuba, confirming its status as a global development institution (24 June 2016)

The International Investment Bank (IIB) and the Central Bank of Cuba (CBC) today signed the Agreement on Cooperation in Organising Financing. The document confirms a special status of the IIB as a global development finance institution represented on three continents and the only multilateral development bank with Cuba as a full member. The signing ceremony took place during the Business Forum “Supporting Economic Growth in Hungary and the CEE Region”, associated with the 105th IIB Council Meeting in Budapest.

Under the terms of the Agreement, parties aim to support and contribute to economic and social development, as well as to improve the efficiency and the level of participation in projects and sectors that are of interest for the Republic of Cuba. The CBC guarantees the due and timely payment of financing, which is organised and implemented by the IIB in relation to projects and programmes in the country, in accordance with the Agreement Establishing the IIB and its Charter and their amended versions. The parties agree to hold consultations and to exchange information in order to meet the Agreement’s aims. In addition, the CBC will assist the IIB in setting up bank accounts in authorised currencies within the Republic’s national banking system.

The Agreement was concluded for a period of 5 years with the possibility of automatic renewal for a further five-year period. It is also important that, in respect of projects, implementation of which starts before the termination of this Agreement, its terms will remain in force until their completion. “Given that the Agreement in fact confirms IIB’s status as a special lender for Cuba, as well as more than significant economic potential of the country with regard to foreign investments, the IIB may soon become an important investment channel to the Republic for its member countries, and, potentially, for non-member countries and other development institutions," – commented Chairman of the IIB Board, Nikolay Kosov, on the signing of the Agreement. He added that additional opportunities for potential investors and historical partners of Cuba stem from the ongoing legislative changes in the country in relation to foreign capital under the Conceptualisation of Cuba’s socio-economic model and the National development plan until 2030, as well as from the implementation of Act 118 of 2014 on foreign investments.

The Agreement further confirms the intensification of the Cuban direction in IIB’s activities, which was relaunched in 2013 after the restructuring of Cuba's debt towards the Bank and the decision by the Cuban Government to remain among shareholders of the institution. In May 2014, the Cuban capital, Havana, hosted the 101st Meeting of the IIB Council, which was the first meeting of the Bank's highest governing body in its modern history on the American continent. At the Havana meeting, a crucial decision was adopted to make fundamental amendments to the statutory documents of the Bank for the first time since the foundation of the institution in 1970.