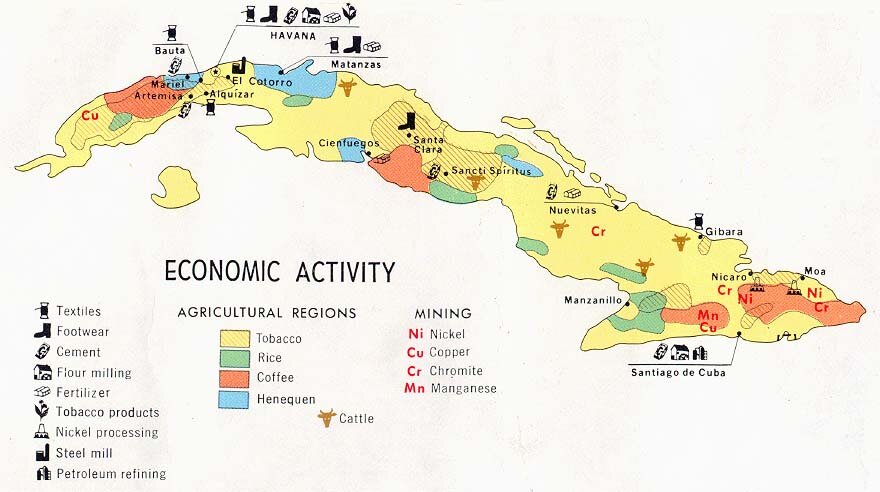

Cuba Has Nickel And Cobalt. Vehicle Electric Batteries Use Nickel And Cobalt. Cuba Should Benefit.

/Bloomberg

New York, New York

21 September 2021

There’s a Fortune to Be Made in the Obscure Metals Behind Clean Power

By Andrew Janes, David Stringer and Adrian Leung

Excerpts:

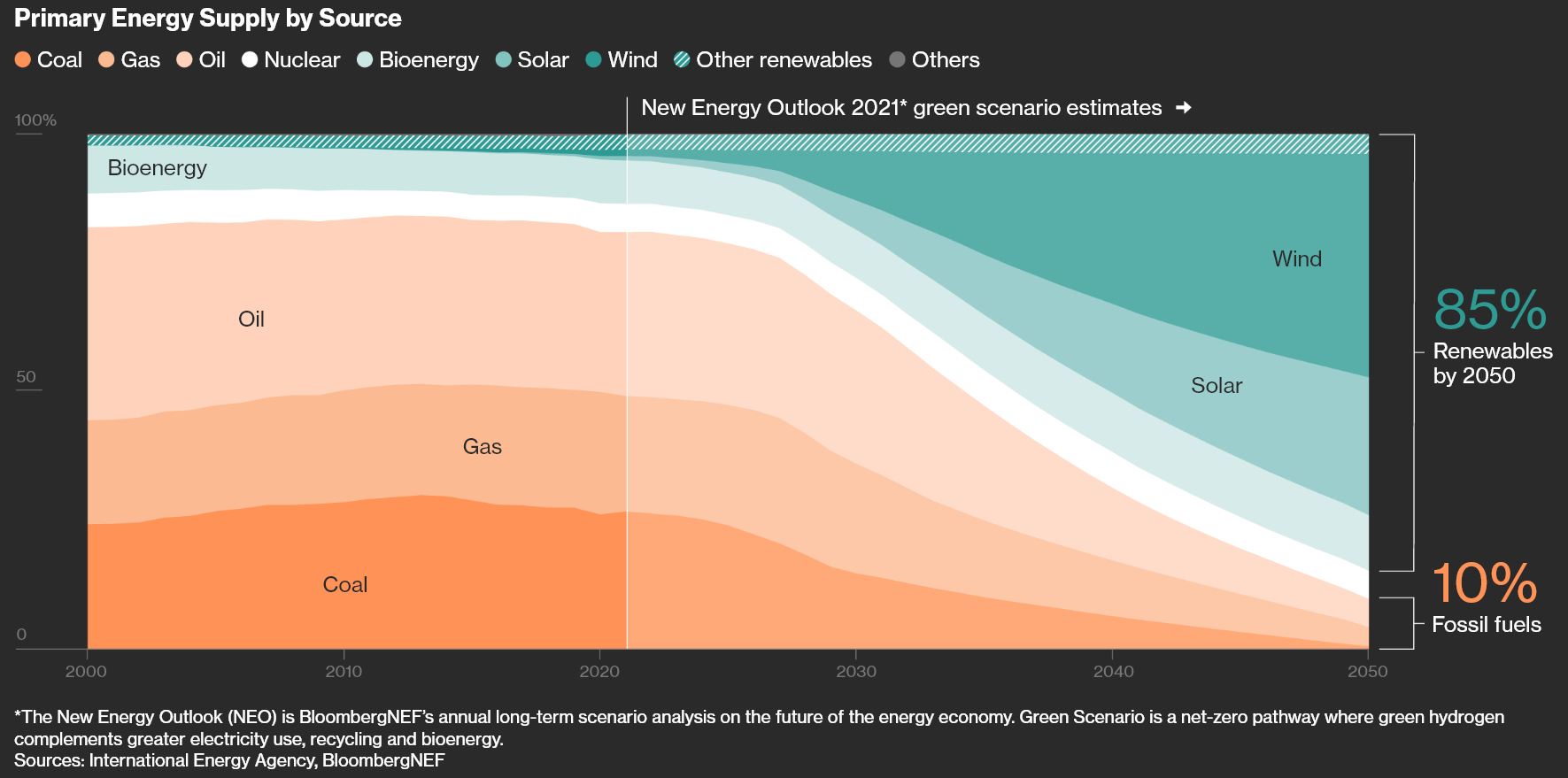

The era-defining shift from fossil fuels to clean energy will deliver an unprecedented new boom for commodities—and an opportunity for investors—as a range of relatively obscure materials become essential to delivering emissions-free power, transport and heavy industry.

The transition could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades, according to research provider BloombergNEF, and will reverberate from lithium-rich salt flats in Chile to polysilicon plants in China’s Xinjiang region.

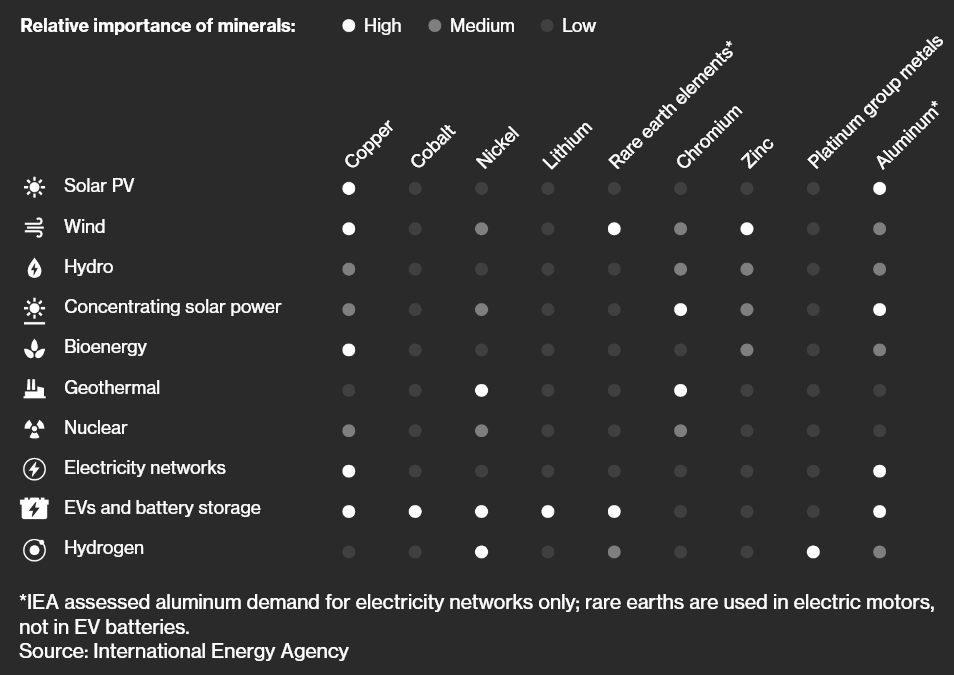

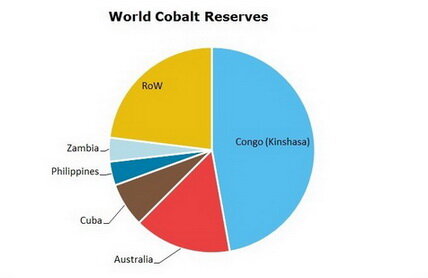

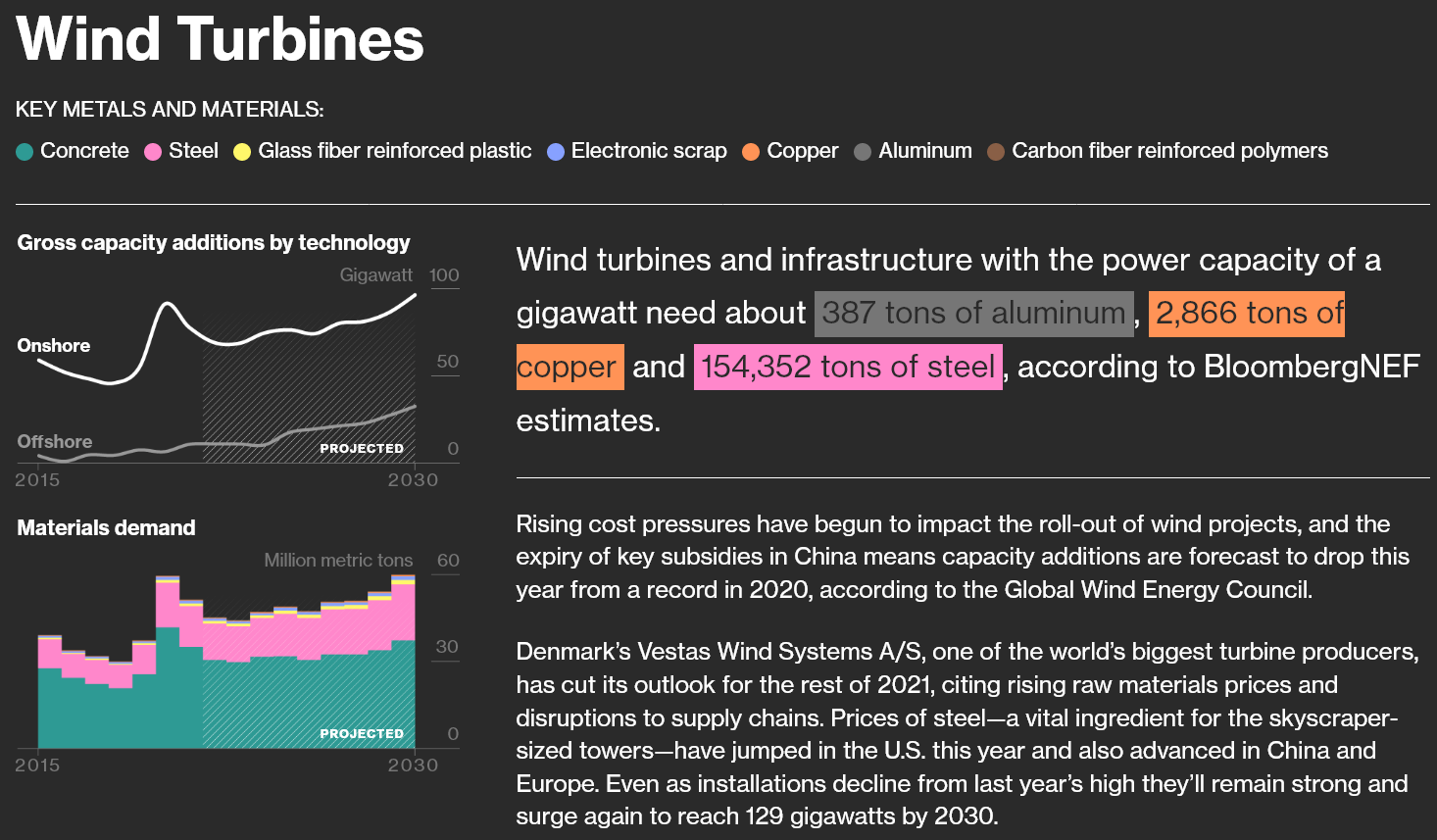

As electric vehicles supplant gas guzzlers, and solar panels and wind turbines replace coal and oil as the world’s most important energy sources, metals like lithium, cobalt and rare earths are on the brink of rapidly accelerating demand, along with more familiar industrial materials like steel and copper.

Prospects for technology manufacturers, metals producers and energy traders are immense, while regular investors are already benefiting. Numerous clean-energy stocks have more than doubled in value since the start of 2020, and the emergence of futures contracts for battery materials and a proliferation of initial public offerings in the sector will extend options to gain exposure.

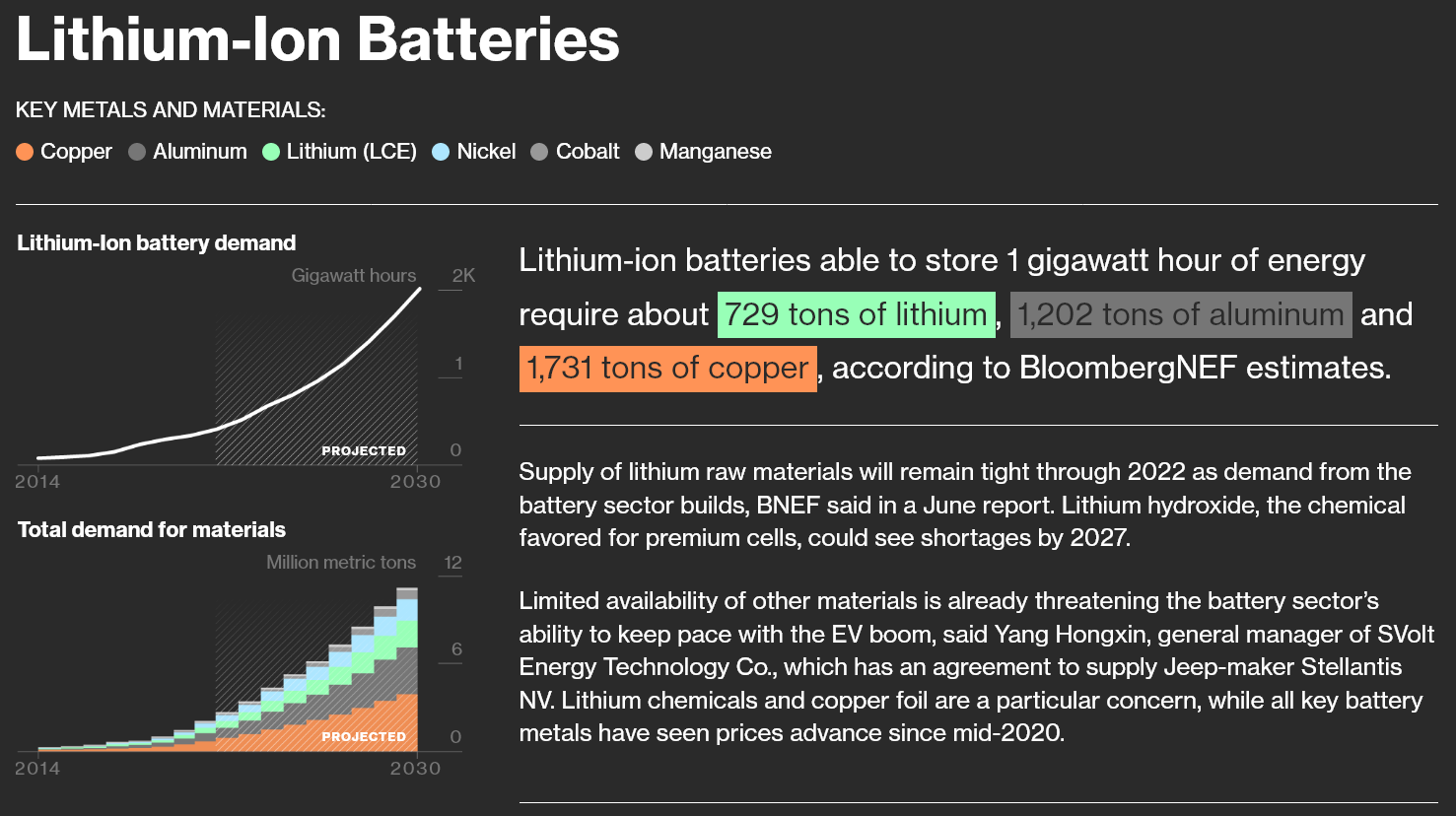

Though shifting demand patterns are being signposted far in advance, project developers urgently need to secure capital for new mines or production lines. Efforts to lift supplies of key raw materials—which can require years of exploration and construction—must begin now to keep pace with future requirements. That pressure could be most pronounced for EV charging infrastructure and lithium-ion batteries, which face steep growth curves, though more established solar and wind sectors have been challenged this year by pricier commodities.

Failing to act fast enough could even risk an economic shock comparable to the oil crises of the 1970s, said Robert Johnston, an adjunct senior research scholar at the Center on Global Energy Policy at Columbia University in New York. Concerns about future bottlenecks are reflected in the eye-watering gains of some green stocks. “I don’t see an easy solution because these supply chains don’t magically appear overnight,” he said.

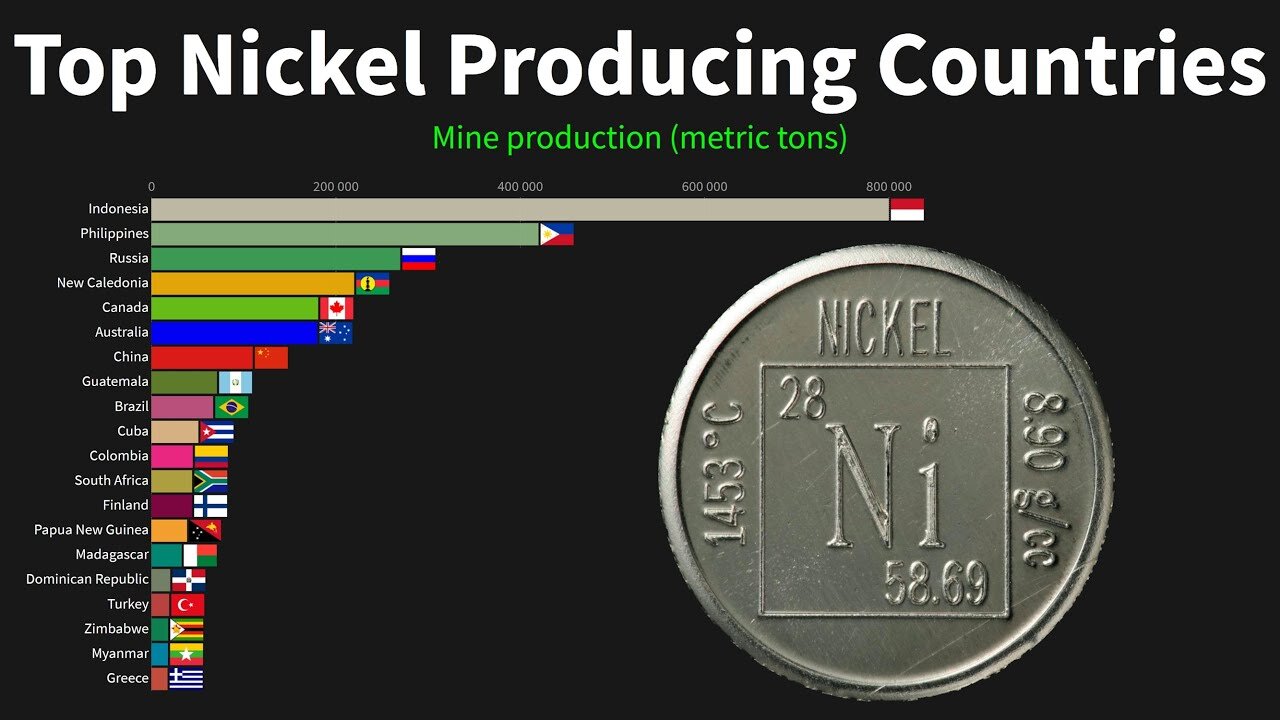

By 2030, demand for cobalt, used in many battery types, will jump by about 70%, while consumption of lithium and nickel by the battery sector will be at least five times higher, according to BNEF. There’ll be a need for more manganese, iron, phosphorus and graphite, while copper, needed in clean energy technologies and to expand electricity grids, will also be a major beneficiary.

Four key components of the energy transition—solar panels, wind turbines, lithium-ion batteries, and EV charging units—show the complexity of supply chains required to help the world quit fossil fuels, and how the need for vast quantities of crucial metals should spur prices higher.

“The supply chain of batteries, especially on the raw material side, needs more investment,” including in new lithium and nickel mines, said Lei Zhang, chief executive officer of Envision Group, which has an agreement to produce batteries for car-makers from Nissan Motor Co to Renault SA.

Battery ingredients nickel and manganese could see some of the most severe shortages later this decade, said Kwasi Ampofo, head of metals and mining at BNEF. There’s enough mined material, but a lack of capacity to process those metals into specialist chemicals could pose problems, he said.

Price swings are a bigger concern in the battery sector because EVs are still approaching cost parity with combustion engine vehicles and higher costs could have an effect on adoption, said Daniel Quiggin, a senior research fellow focused on energy, environment and resources at London’s Chatham House.

As the energy transition supercycle gets closer, a major question is whether miners, financiers and governments can mobilize enough capital fast enough to bring on new supplies in line with demand. That means raw materials and the companies that produce them should offer higher returns—though also more risk—than component manufacturers, equipment makers or electric car producers, according to Pala’s Fung.

“It doesn't matter what battery chemistry you have, lithium is needed across all of them, and nickel is needed in many of them,” she said. “If it's solar or wind or EV charging units, you need copper to connect it all together—that’s why we like looking at these commodities.”

The world’s biggest mining firms, including BHP Group and Glencore Plc, are emphasizing their links to clean energy, while smaller competitors are surging. Lithium producers including Pilbara Minerals Ltd. and Orocobre Ltd. are advancing faster this year than battery giants like Contemporary Amperex Technology Co. and are among the top performers in the Bloomberg Electric Vehicles Total Return Index.

Still, green-focused equities have stumbled before. Valuations of solar equipment makers plunged from a 2007 peak, and lithium miners suffered more than two years of losses through early 2020 before resuming gains.

Investors need to carefully time moves to add exposure to the energy transition theme, said Camille Simeon, a Sydney-based investment manager at Aberdeen Standard Investments, which manages global assets worth about $635 billion. They should also be prepared for cyclical price swings that impact almost all commodities, and be wary of frothy valuations.

“It’s very clear that demand is accelerating for the raw materials that go into those products,” she said. “You also need to consider, because we are talking such a long-dated timeframe, how plausible and realistic is that, and how much do you want to pay for that at this point in time?”

LINKS To Media Reporting:

Panasonic supplier may have used Cuban cobalt in Tesla batteries

Exclusive: Tesla's battery maker suspends cobalt supplier amid sanctions concern