Despite Nickel Prices At Seven-Year High, Cuba Owes Sherritt Approximately CA$156 Million; Sherritt "continues to be in discussion with its Cuban partners to expedite payment of overdue receivables."

/Sherritt International Corporation

Toronto, Canada

10 February 2022

“Sherritt is a world leader in the mining and refining of nickel and cobalt -- metals essential for the growing adoption of electric vehicles. Its Technologies Group creates innovative, proprietary solutions for oil and mining companies around the world to improve environmental performance and increase economic value. Sherritt is also the largest independent energy producer in Cuba.”

LINK To Review of Financial and Operational Results

LINK To 2021 Fourth Quarter Report (2021 Annual Report)

Q4 Earnings Call- Review of Financial and Operational Results

Excerpts (emphasis added):

Cash and cash equivalents at December 31, 2021 were $145.6 million, down from $163.4 million at September 30, 2021. During the quarter, the Moa JV deferred distributions to its partners as it assessed the impact of delays in customer deliveries caused by flooding in B.C. and congestion at the Vancouver port on its expected cash needs. Subsequent to the year end, Sherritt received $8.1 million as its share of Moa JV distributions.

During the quarter, the Corporation received US$6.5 million in Cuban energy payments, which were offset by the interest payment of $14.8 million on the second lien notes and sustaining capital expenditures of $2.9 million.

During 2021, Sherritt received a total of $52.8 million in direct and re-directed distributions from the Moa JV and its partner, General Nickel Company S.A. (GNC).

Received US$6.5 million in Cuban energy payments. Sherritt anticipates continued variability in the timing of collections into 2022, and is working with its Cuban partners to ensure timely receipts.

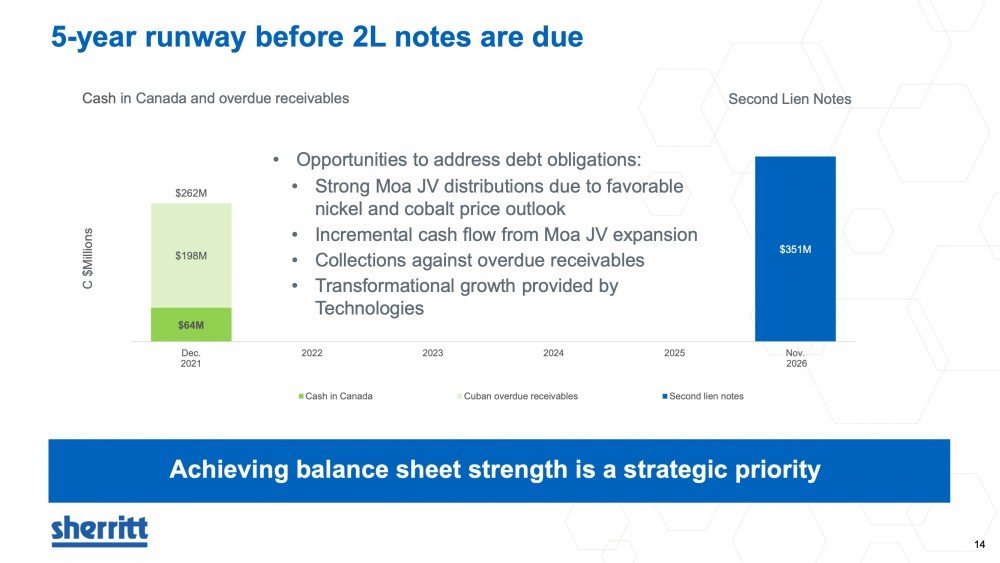

Total overdue scheduled receivables at December 31, 2021 were US$156 million, up from US$152.5 million at September 30, 2021. Subsequent to year end, Sherritt received US$2.2 million in Cuban energy payments. Collections on overdue amounts from Sherritt’s Cuban energy partners continue to be adversely impacted by Cuba’s access to foreign currency as a result of ongoing U.S. sanctions and the global pandemic. While Sherritt anticipates improved economic conditions in Cuba in 2022, it continues to anticipate variability in the timing and the amount of energy payments in the near term, and continues to work with its Cuban partners to ensure timely receipt of energy payments.

Of the $145.6 million of cash and cash equivalents, $64.2 million was held in Canada, down from $82.1 million at September 30, 2021 and $78.9 million was held at Energas, up from $76.7 million at September 30, 2021. The remaining amounts were held in Cuba and other countries.

Nickel prices hit a seven-year high in Q4 2021, climbing to US$9.59/lb on November 24. The price increase was driven by improving market fundamentals, including strong demand from across multiple industries, consumer stockpiling, reduced inventory levels, and ongoing supply disruptions caused by COVID-19. Rising nickel prices and favourable market conditions were jolted by the rapid spread of the Omicron variant and concerns of its impact on the global economy in early December, causing prices to soften slightly through to the end of the quarter. Nickel prices closed the year at US$9.49/lb, representing a 27% increase for 2021 relative to the closing price of 2020 of US$7.50/lb.

Since the start of 2022, nickel prices have sustained their recent momentum, reaching US$10.89/lb on January 21, the highest price in more than 10 years. It is anticipated that nickel prices will maintain their current robustness through the end of 2022 based on forecasts provided by industry analysts.

Strong nickel demand in Q4 was reflected by the continued decrease in inventory levels since the start of 2021. In Q4, nickel inventory levels on the London Metals Exchange (LME) fell by 35% from 157,062 tonnes at the start of the period to 101,886 tonnes on December 31. Similarly, inventory levels on the Shanghai Futures Exchange fell 35% to 2,406 tonnes, down from 3,728 tonnes at the start of the quarter.

Industry analysts, including Wood Mackenzie and S&P Global, have forecast continued strong demand and market tightness through to the end of the 2022. LME nickel inventories continued to decline in 2022, falling below 100,000 tonnes on January 10, reaching 85,644 tonnes on February 9, the lowest level since November 2019.

Visibility of market fundamentals, including inventory levels, in the mid-term is limited given the economic uncertainty caused by the pandemic and news from Indonesia suggesting that the country, one of the world’s largest suppliers of nickel, plans to curtail exports in an effort to support a domestic refining and processing activities.

The long-term outlook for nickel remains bullish on account of the strong demand expected from the stainless steel sector, the largest market for nickel, and the electric vehicle battery market. Some market observers, such as Wood Mackenzie, have forecast a prolonged nickel supply deficit beginning in 2025 due to recent developments in the electric vehicle market and insufficient nickel production coming on stream in the near term.

Over the past year, multiple automakers and governments have announced plans for significant investments to expand electric vehicle production capacity to meet growing demand as well as more aggressive timelines to phase out the sale of internal combustion engines. In 2021, more than 6.5 million plug-in electric vehicles were sold despite the global pandemic. Industry observers estimate that the number of electric vehicles sold in 2022 will grow to 8.6 million units. CRU has forecast that electric vehicles sales will grow to 17.4 million units by 2025.

As a result of its unique properties, high-nickel cathode formulations remain the dominant choice for long-range electric vehicles manufactured by automakers with Class 1 nickel being an essential feedstock in the battery supply chain. Sherritt is particularly well positioned given our Class 1 production capabilities and the fact that Cuba possesses the world’s fourth largest nickel reserves.

Cobalt prices rose steadily in Q4 2021, closing on December 31 at US$33.78/lb, up 30% from US$25.88/lb at the start of the quarter according to data collected by Fastmarkets MB.

Higher cobalt prices in Q4 2021 were primarily driven by increased buying from electric vehicle battery manufacturers. Cobalt is a key component of rechargeable batteries providing energy stability. Higher cobalt prices in Q4 2021 were also impacted by increased stockpiling by consumers and ongoing supply logistics disruptions in South Africa, where cobalt produced in the Democratic Republic of Congo, the source of almost two-thirds of the world’s supply, is sent before being shipped internationally.

Industry observers, such as CRU, expect cobalt prices to continue to be robust in the near term as limited new sources of supply have been announced to fill expected demand over the next five years.

The outlook for cobalt over the long term remains bullish as demand is expected to grow to approximately 280,000 tonnes by 2025, representing a compound annual growth rate of 13.5% according to CRU.

Sherritt continues to be in discussion with its Cuban partners to expedite payment of overdue receivables, increase availability of natural gas needed for power production activities, and extend the power generation agreement with Energas, which is currently slated to expire in March 2023. In Q4 2021, Sherritt received approval from the Energas board for a feasibility study extending the Power agreement, and submitted a formal application for the extension to the Cuban government.

Forward-Looking Statements

These risks, uncertainties and other factors include, but are not limited to, the impact of infectious diseases (including the COVID-19 pandemic), changes in the global price for nickel, cobalt, fertilizer, oil, gas, or certain other commodities; security market fluctuations and price volatility; level of liquidity; access to capital; access to financing; the risk to Sherritt’s entitlements to future distributions from the Moa Joint Venture; uncertainty about the pace of technological advancements required in relation to achieving ESG targets; identification and management of growth opportunities risk of future non-compliance with debt restrictions and covenants; Sherritt’s ability to replace depleted mineral reserves; risks associated with the Corporation’s joint venture partners; variability in production at Sherritt’s operations in Cuba; risks related to Sherritt’s operations in Cuba; risks related to the U.S. government policy toward Cuba, including the U.S. embargo on Cuba and the Helms-Burton legislation; potential interruptions in transportation;