Airbnb Successfully Lobbied Trump Administration. Airbnb Should Now Focus On Biden Administration To Advocate For Direct Correspondent Banking So Hosts In Cuba May Access Funds Directly, Efficiently.

/At Peak Year, There Were 40,000 Airbnb Listings In Cuba Whose Hosts Were Paid Approximately US$60 Million.

Airbnb Spent US$250,000.00 To Successfully Lobby Trump-Pence Administration (2017-2021) To Exempt Private Homes From Its Restrictions.

Airbnb Should Now Direct Its Energies Towards The Biden-Harris Administration (2021- ) To Advocate For Direct Correspondent Banking So Hosts In Cuba May Access Funds Directly, Efficiently, And Transparently.

The Less Airbnb Hosts In Cuba Pay To Receive Their Payments, The More Funds Will Be Available For Investments In Their Properties.

San Francisco, California-based Airbnb, Inc. (2021 revenues US$6 billion. The company reported that its Host community had six million active listings and earned US$34 billion in 2021).

In 2015, the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury authorized Pompano Beach, Florida-based Stonegate Bank to have an account with Republic of Cuba government-operated Banco Internacional de Comercia SA (BICSA), a member of Republic of Cuba government-operated Grupo Nuevo Banca SA, created by Corporate Charter No. 49 on 29 October 1993 and commenced operation on 3 January 1994.

Stonegate Bank provides commercial operating accounts for the Embassy of the Republic of Cuba in Washington, DC and the Permanent Mission of the Republic of Cuba to the United Nations in New York City; the financial institution also handles other types of OFAC-authorized transactions. In September 2017, Stonegate Bank was purchased by Conway, Arkansas-based Home BancShares (2021 assets approximately US$17.7 billion) through its Centennial Bank subsidiary.

Despite intense advocacy, the Obama-Biden Administration (2009-2017) National Security Council (NSC) inexplicably and stubbornly to permit BICSA a correspondent account with Stonegate Bank, so Stonegate Bank was required to use third country financial institutions. Transactions for approximately eighty (80) customers were managed on a regular basis through Panama City, Panama-based Multibank, which had dealing with Republic of Cuba government-operated financial institutions in the Republic of Cuba.

Absent bilateral direct correspondent banking accounts, the payment process for funds from the United States to the Republic of Cuba and from the Republic of Cuba to the United States remains triangular rather than a straight line- which would be more efficient, more secure, more transparent, more timely (same day versus two or more days), and less costly.

NOTE: Since the first exports of agricultural commodities from the United States to the Republic of Cuba in December 2001, more than US$6,622,784,996.00 has been received as payment from the Republic of Cuba- every penny through a third country where a financial institution takes a fee.

Grupo Aval Of Colombia Purchase Of Multibank

On May 11, 2020 Grupo Aval informed that its subsidiary Banco de Bogotá (through its subsidiary Leasing Bogotá S.A. Panamá) has agreed to amend the purchase agreement for up to 100% of the outstanding common shares (the “SPA”) of Multi Financial Group, Inc. (“MFG”), parent company of Panamanian bank Multibank. From Grupo Aval On 16 June 2020: “On May 25th, Banco de Bogotá, through its subsidiary Leasing Bogotá S.A. Panamá, acquired 96.6% of the ordinary shares of Multi Financial Group. As part of the acquisition process, MFG’s operation in Cuba was closed and as part of the transaction. Grupo Aval complies with OFAC regulations and doesn't have transactional relationships with Cuba.”

“Grupo Aval Acciones y Valores S.A. (“Grupo Aval”) is an issuer of securities in Colombia and in the United States. As such, it is subject to compliance with securities regulation in Colombia and applicable U.S. securities regulation. Grupo Aval is also subject to the inspection and supervision of the Superintendency of Financeas holding company of the Aval financial conglomerate.

The OFAC should rephrase existing regulations to make easier, more transparent, and less costly for entrepreneurs in the Republic of Cuba to engage with their counterparts in the United States and for entrepreneurs in the United States to engage with their counterparts in the Republic of Cuba. Only an individual absent private sector commercial experience would believe strangling the movement of capital benefits the United States in its re-engagement with the re-emerging private sector (self-employed) the Republic of Cuba.

If the Biden-Harris Administration wants to increase the demand from entrepreneurs in the United States to re-engage with entrepreneurs in the Republic of Cuba, and simultaneously frustrate the Miguel Diaz-Canel Administration (2018- ) in the city of Havana, then increase, overwhelm the supply of the means of production. This begins with the efficient and transparent movement of capital.

Does This Make Sense? Initially, It Does- But Then Falls Apart

Today, an individual subject to United States jurisdiction 1) may travel to the Republic of Cuba 2) use credit cards and debit cards in the Republic of Cuba 3) open a bank account in the Republic of Cuba 4) use a bank, credit union, or money services business to process remittances to or from the Republic of Cuba 5) utilize online payment platforms to facilitate or process authorized transactions involving the Republic of Cuba and 6) send remittances (gifts not loans or investments) to certain individuals and independent non-governmental organizations in Cuba that encourage the development and operation of private businesses by self-employed individuals.

Today, a company subject to United States jurisdiction 1) may process credit and debit card transactions for individuals traveling to, from, or within the Republic of Cuba, and related settlements, for third-country financial institutions 2) financial institutions may have a correspondent account at a financial institution in the Republic of Cuba 3) financial institutions in the Republic of Cuba may not have a correspondent account with a United States financial institution 4) banking institutions are not permitted to process “U-turn” transactions, i.e., funds transfers originating and terminating outside the United States, where neither the originator nor the beneficiary is a person subject to United States jurisdiction 5) may export medical equipment, medical instruments, medical supplies, pharmaceuticals, informational materials, artwork, agricultural commodities and food products 6) may import agricultural commodities, artwork, informational materials, and products produced by registered self-employed and 7) may import medications for clinical trials and create joint ventures to market the medications.

Here is the rub: Mr. Smith from Washington DC may have an account at a bank in Havana, but Mr. Smith may not directly transfer any money from his checking account in Washington DC to his account at the bank in Havana. He may transfer the funds from Washington to Paris and then from Paris to Havana. If Mr. Smith wants to have an investment in an independent business in Havana, wants to receive payment for a product or service sold to an independent business, wants to send additional funds, or receive a profit-sharing payment from an independent business, United States regulations do not permit him to do so.

Today, when receiving payment from the Republic of Cuba or sending payment to the Republic of Cuba there is no straight-line transaction. It is a triangle. And often not an equilateral triangle or isosceles triangle. Distance can create an acute triangle or obtuse triangle. In banking, triangles are harmful, not helpful.

A financial institution in a third country is always involved- and it receives a fee for that involvement. Is the triangle necessary? No. Does the triangle provide the United States government with increased opportunities to monitor the transactions? No. Does the triangle increase the cost for an individual subject to United States jurisdiction and company subject to United States jurisdiction? Yes. Does the triangle increase the cost to a Republic of Cuba national and Republic of Cuba-based company? Yes.

Inflicting as much pain as possible upon those engaging in a transaction involving the United States was never logical as it served as a perpetual boomerang of pain for those involved in statutorily protected export transactions. The message to agricultural interests in the United States- you may legally export your products to the Republic of Cuba, but by the time you are done, you wish you hadn’t done so. That is an inspirational message from the taxpayer-funded United States Department of State, United States Department of the Treasury, United States Department of Agriculture, and United States Department of Commerce? Reminds of… “We’re from the government and here to help…”

United States policy is not solely focused upon increasing the financial costs associated with engagement with the Republic of Cuba. The focus is also upon increasing inefficiencies for each transaction. The goal is to assault individuals and companies with an upper cut (increased costs) and a body blow (inefficiencies) and a left jab (multiple compliance layers for each transaction). Most companies do not wait for a TKO or KO, they throw in the towel.

When a United States-based financial institution employee reads “Cuba” on any document (outgoing or incoming), there is a nearing 100% certainty the transaction will be subjected to additional compliance review and then returned to the customer- even if the transaction is specifically authorized. If the transaction makes it past an employee, computer systems will most certainly flag it and terminate it. Financial institutions in the United States are warry of all Republic of Cuba-related transactions. For the farmer awaiting payment for a shipment of poultry, soybeans, corn, wood, and other products, the delay is unhelpful to their already challenging bottom-line.

One-Way Correspondent Banking Does Not Work

Sending investment funding and providing loans to someone who wants to have or wants to expand a small business can be transformative. Is not the goal of the Biden Administration to extract as many Republic of nationals as possible from commercial and economic reliance upon the government of the Republic of Cuba?

Would not be impactful for registered self-employed and Micro, Small and Medium-Size Enterprises (MSMEs) to open hundreds, thousands of accounts at financial institutions in the Republic of Cuba? Where they could receive funds transparently and directly from their investor or customer within hours. Where they could deliver profit-sharing funds and supplier payments transparently and directly within hours. Each transaction transparent and compliant with United States financial institution regulations. Yes, the transaction activity could overwhelm the financial sector within the Republic of Cuba- but, would that be such an undesired outcome? The financial sector would be required to meet the demand or explain to customers the reasons for the failure to adapt to the marketplace.

The Republic of Cuba may not embrace direct correspondent banking due to the requirements of the United States Department of the Treasury, United States Department of Justice, and United States Federal Reserve for all correspondent accounts regardless of country. Again, there is a point here- let it be the Republic of Cuba who declines to re-establish a “normalized” financial landscape with the United States.

Regarding the re-authorization of “U-turns” where financial institutions were permitted to process non-United States-related transactions involving the Republic of Cuba, the prism through which a decision to again permit “U-turns” should not be solely whether permitting “U-turns” benefits the Republic of Cuba. It does. More important is the transparency required for “U-turns” which remains an important goal of the United States. Also, not permitting “U-turns” is an additional reason for financial institutions to avoid all Republic of Cuba-related authorized transactions.

If the Biden-Harris Administration wants “prosperity in Cuba” then it should re-calibrate the means to that end. Doing so will demonstrate removing impediments for re-engagement with the self-employed in the Republic of Cuba is the most efficient means of creating indigestion for the government of the Republic of Cuba.

No one in the United States must engage commercially with the Republic of Cuba. The Biden-Harris Administration must seed the garden. Those seeds must be focused upon making easier and more transparent the movement of funds and the use of those funds. And commercial engagement with the Republic of Cuba should not have a unique “carve-out” for individuals of Cuban descent who are subject to United States jurisdiction. The Biden-Harris Administration should ensure that all individuals subject to United States jurisdiction are subject to the same regulations as those regulations relate to commercial engagement with the Republic of Cuba.

Link To Related Post

Remittances: Will Biden-Harris Administration Repeat Mistakes Of Obama-Biden Administration And Learn From Mistakes Of Trump-Pence Administration? No Triangles. Yes Loans. Yes Investments. May 18, 2021

Rest of World

New York, New York

4 April 2022

How Airbnb reshaped Cuba’s tourism economy in its own image

The booking platform was a game changer on the island, but the embargo still fosters some tension between Cubans and the U.S. company.

By Leo Schwartz and Lidia Hernández-Tapia

Lorelis García de la Torre hails from the Cuban city of Camagüey but has always loved the stately old colonial homes of Havana, many crumbling and long past their glory days. She left Cuba in 2006, first for Spain and then Canada. Shortly after, the country’s tourism industry heated up, with aspiring entrepreneurs buying up properties to turn into casas particulares, private homes available for rent. In 2014, she made an offer on a two-story house in the neighborhood of Vedado.

Three years later, she opened the newly renovated house for business, naming it Casa Brava. But instead of renting it out through word-of-mouth or booking agencies, as Cubans had done for years, she first listed it on Airbnb. “It was the only way I knew of where Cubans had access and could receive payments,” she said.

But Airbnb didn’t just offer Cubans like García de la Torre a means of renting their properties to tourists in a simple and centralized way. According to interviews with hosts, guides, service workers, and hotel industry professionals, Airbnb fundamentally changed the way that tourism operates on the island, replacing the country’s decades-old casa particular system and transforming entire neighborhoods to serve the needs of new clients with different expectations. Airbnb declined to be interviewed for this article.

Lorelis García de la Torre bought a two-story house in Havana and turned it into a rental property on Airbnb. Lorelis García de la Torre

The uniquely Cuban system of casas particulares grew out of the country’s so-called Special Period, after the fall of the Soviet Union in the early 1990s. The government began to open up the housing market, allowing for the sale of private homes for tourist accommodation. Ricardo Torres Pérez, an economist and research fellow at American University, in Washington D.C., said that, as a result, “the number of visitors grew exponentially.” The casas particulares offered something that other accommodations couldn’t. “Before it was a business, it was somebody’s home,” said Alison Coelho, who has been leading tourism experiences in Cuba since 2000.

The model felt, and looked, not so different from the one Airbnb pitched when it was founded in 2008. “Hotels leave you disconnected from the city and its culture,” the company’s original pitch deck read. “Book rooms with locals.”

“Airbnb is definitely a continuation of the casa particular model,” said Tom Popper, an expert on Cuban tourism from 82° West Consultants, a firm focused on business entry to Cuba.

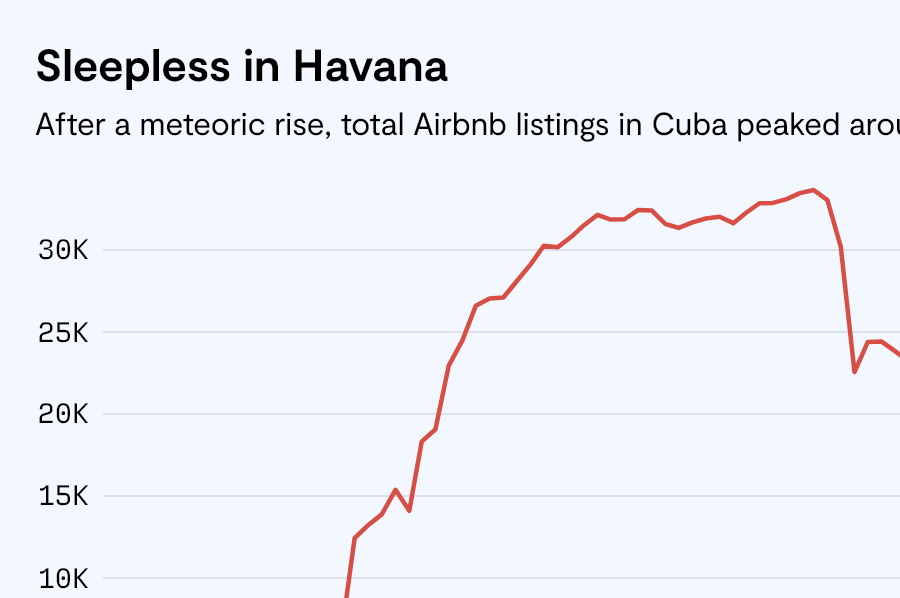

Airbnb entered the Cuban market in 2015 to much fanfare, as President Obama eased travel restrictions. In its first year of operations, the platform brought 4,000 of Cuba’s estimated 20,000 casas particulares onto its platform. Current data provided to Rest of World from the short-term rental data provider AirDNA shows that by May 2017, the total number of Airbnb listings had topped 20,000, essentially subsuming the casa particular market. Listings peaked at almost 35,000, the summer before Covid-19. According to tourism experts, Airbnb made the casa particular model easier for both guests and owners, providing a place to not only list properties but make payments, rather than rely on word-of-mouth and cash. Furthermore, people like García de la Torre were buying properties to list them on Airbnb — people from not only Cuba but other countries like Italy and Spain as well. Airbnb’s entry into Cuba coincided with an increase in tourism to the island overall, with the number of travelers growing by over 50% between 2014 and 2018. Tourism from the United States nearly quadrupled between 2015 and 2018.

Yusleidys Pérez Ugarte, a travel agent who worked with the government until the pandemic hit, said that the expansion of private home rentals under Airbnb quickly took precedence over the hotel industry. “It’s not a secret to anyone that the hotels in Cuba are expensive and don’t have the best service,” she said. “During Obama’s term, when relations improved and Americans began to come, the private houses expanded because hotels could not keep up.”

According to residents, neighborhoods in Havana began to transform under the new influx of development and tourists. Adriana Ricardo Díaz is the director of Arte Corte, a nonprofit community project in Old Havana that trains hairdressers. “During the years before the pandemic, the private sector took off, especially in the rental housing market,” she said. “Improvement didn’t look like the gentrification that you usually see in other countries, with its devastating impact. … People sold their houses that were in bad conditions, and there was a recuperation of wealth.”

Cubans began to take advantage of Airbnb’s experiences feature as well. Ricardo Díaz offered experiences centered around cocktail making and would show tourists around Arte Corte. Manuel Fortún Manzano, a 29-year-old from Havana, was working in human resources for a government-run construction company when his friend told him about Airbnb in 2018. He began offering an experience called “The Havana Whisperer,” where he would teach tourists about everything from how to change money to what neighborhoods to visit (accompanied by cocktails and food, of course). It quickly became his main source of income. “More than anything, it provided me with economic autonomy,” he told Rest of World.

David Ferrán had been working as a tour guide in Havana when Airbnb came to the country. Before, people struggled to promote their tours and find clients. “What Airbnb did was allow a lot of people working as tour guides for the state to start working independently,” he told Rest of World. Ferrán began to create different experiences for the platform, going so far as to open a family-run spa business, which he now operates outside of Airbnb. Havana is still the main hub for tourists in Cuba, but parts of the country that had never seen tourism changed as well. According to several hosts and Pérez, the American University economist who spoke with Rest of World, Airbnb was able to open different regions to private home rentals in a way that casas particulares never could.

Manuel Fortún Manzano launched his Airbnb tourism experience in 2018 and it quickly became his main source of income. https://www.airbnb.es/experiences/156319

Nadal Antelmo Vizcaíno is originally from Santa Marta, a small town bordering the popular tourist destination of Varadero Beach, about two hours east of Havana. He moved to Miami in 2016 but decided to list his house on Airbnb in 2017, after he saw its burgeoning footprint on the island. At first, his town was slow to adapt to the platform. “There weren’t more than five or 10 houses [on Airbnb],” Antelmo told Rest of World. But as he went back each year, he began to see how much the town was changing. New restaurants and cafés opened. There was a construction boom to satisfy demand for more houses. “Airbnb completely revolutionized Santa Marta,” he said.

Evelio Jesús Medero Vázquez was a taxi driver in the Varadero area between 2015 and 2018, driving the type of classic car that has become synonymous with Cuba — in his case, a 1956 Porsche. He began to do more trips back and forth from Havana, shuttling tourists, mostly staying at Airbnbs, to the beach town. “It created a constant flow of clients who wanted to learn more about Cuba,” he said. Like Antelmo, he saw how quickly the towns around Varadero changed. Upscale new restaurants popped up, and people who owned classic cars like himself were servicing thousands of tourists a day. “Places that used to be dumps or abandoned were becoming … clean and beautiful places,” he told Rest of World. “Airbnb was an unprecedented driving force.”

“There were definitely bumps in the road,” said Popper, the tourism consultant. Internet access was one. Some casa particular owners, long used to operating through word-of-mouth, were unable to adapt to the new technology. Rodolfo Rodríguez Trejo has been renting his property in the Vedado neighborhood in Havana for over 20 years. When Airbnb opened in Cuba, he tried to sign up for the platform, but his internet access was spotty, and he wasn’t able to create an account. "Places that used to be dumps or abandoned were becoming…clean and beautiful places. Airbnb was an unprecedented driving force."

Another pain point for Cuban hosts was payment. People with dual citizenship or operating from other countries, like Antelmo, could accept payments through non-Cuban bank accounts. However, Cubans still in the country and with no other nationalities were faced with payment issues on the platform.

On a plane to Miami in 2018, Rodríguez Trejo met an Airbnb host who told him that he was going to the company’s headquarters to ask them for overdue payments. After hearing this testimony, Rodríguez Trejo felt good about his decision to not use the platform. “In Cuba, it’s a struggle to buy things like butter, cheese, and eggs,” he told Rest of World. “It takes a lot of time and effort to then have to also deal with delayed payments for months.” As Airbnb took over the casa particular model, two years after its launch in Cuba, the platform was handed an advantage over its remaining main competitor: hotels.

New rules under the Trump administration restricted where U.S. citizens could stay, forcing Marriott to cease operations on the island. Instead, after Airbnb reportedly spent a quarter million dollars in lobbying efforts, the U.S. government encouraged visitors to Cuba to stay at private homes. Alessandro Benedetti, the executive assistant manager at Gran Hotel Manzana Kempinski in Havana, one of the premiere hotels in Cuba, said that, normally, Airbnb would not be a direct competitor with the luxury hotel market. That was not the case in Cuba, where Americans made up the biggest percentage of guests before the pandemic. “For this particular market, I would say that for hotels, Airbnb is the competition,” he told Rest of World. “Many tourists want to come to Cuba but are concerned with the regulation, so they go the safer way.”

While the Trump administration’s more restrictive policies began to diminish the flow of tourism to Cuba, the pandemic nearly shut it off. Except for a brief period in the summer of 2020, Cuba’s borders were closed to international travelers for nearly all of 2020 and 2021, finally reopening in 2021. Hotels were closed, and Airbnb occupancy dropped precipitously.

Now, with tourism on the rebound, it’s unclear to tourism experts whether Airbnb is better positioned than hotels. Properties like the Kempinski resorts continue to open in Cuba, offering the types of luxury experiences that were unavailable on the island before the pandemic. García is hopeful that Airbnb business will rebound with the easing of the pandemic. She’s even helping her nephew restore an antique house in the town of Trinidad in central Cuba, about four hours east of Havana. Her vision is that once it opens, they can bring guests on a tour between the two houses. “Even though people don’t have hope in Cuba, I think there is a lot of future in this country,” she said.

The Hill

Washington DC

11 November 2017

Airbnb’s Cuba lobbying blitz pays off

By Melanie Zanona

Airbnb launched an ambitious lobbying blitz this summer to claw back some of President Trump’s planned new restrictions on Cuban travel — and the effort appears to have paid off.

The popular travel-booking site, which considers Cuba its fastest-growing market, successfully secured language in Trump’s regulations issued this week that will allow Americans to stay in private homes, which are often listed on Airbnb, if they visit the island to support the Cuban people.{mosads}The victory for Airbnb underscores the White House’s struggle to balance its promised crackdown on Cuba with the interests of U.S. businesses, which have overwhelmingly supported former President Obama’s historic opening with the island nation.

“Airbnb was founded on the belief that travel helps to break down barriers between people and countries and contributes to a greater understanding of the world,” Airbnb said in a statement to The Hill. “We appreciate that hosts will continue to have the chance to share their space and that guests can continue to visit the island. Hosts in Cuba have welcomed guests from around the world and these regulations will allow Airbnb to keep supporting individual Cuban people who share their homes.” The White House unveiled the details of its new Cuba policy on Wednesday, nearly five months after the president directed agencies to craft new rules tightening travel and commercial ties to Cuba. The effort was aimed at fulfilling Trump’s campaign promise to reverse Obama’s thaw with the communist-run country.

But internally, the Trump administration wrestled with how far to go in cracking down on the communist regime, according to two sources familiar with the discussions. Trump ended up leaving the core of Obama’s Cuba policies intact. The new rules that did come down, and which took effect Thursday, restrict Americans’ ability to travel to Cuba and prevent business deals with certain entities controlled by the Cuban government and military.

The government will no longer allow individual “people-to-people” trips for educational purposes, meaning visitors must travel to Cuba with a licensed tour group instead of going on their own. But there is an exception that helps companies like Airbnb.

Obama had allowed Americans to travel to Cuba for 12 different reasons, though tourism was still strictly prohibited. The individual “people-to-people” category became one of the more popular ways to see Cuba and has been credited with bringing a flood of American visitors to the island. More than 346,000 American citizens visited the island during the first six months of 2017 — a 149 percent increase from the same time last year. Commercial flights between the U.S. and Cuba resumed last August, while Obama restored diplomatic ties with Cuba in 2015. A wide range of Cuban and U.S. businesses have been racing to cash in on the travel surge, with Airbnb becoming one of the major beneficiaries of Obama’s relaxed travel rules.

Private bed-and-breakfasts, or “casa particulares”, have long been a common way to stay in Cuba. Since Airbnb started operating on the island in the spring of 2015, at least 22,000 rooms have been listed on the travel-booking site and $40 million was paid to Cuban individuals who shared their home. About 35 percent of Cuba’s Airbnb guests are American, the San Francisco-based startup added.

But Trump’s June announcement that he would be restricting travel to Cuba sent shivers through the travel and tourism industry. Their top concern was about the shift from individual to group travel – a model that is far more difficult for bed-and-breakfasts and other small businesses to accommodate. So Airbnb went to work, setting up a new in-house team to lobby on the issue and spending a quarter of a million dollars over six months. Previously, Airbnb had only hired outside firms to lobby on its behalf, but it began to expand its footprint in Washington around the same time it started lobbying on Cuba for the first time ever. Meagan McCanna, who was brought on to lead Airbnb’s federal affairs last December, became a registered lobbyist for the company starting in May.

Between April and June, when Trump first announced the Cuba changes, Airbnb spent $160,000 to lobby on issues including “general discussions regarding the Executive Order related to Cuba.”

And from July to September, when the National Security Council and other relevant agencies were in the process of actually drafting language to carry out Trump’s order, Airbnb spent $90,000 to lobby the council on Cuba, among other things. The company’s strategy was to educate policymakers about how the platform works and highlight how the sharing economy has benefited the Cuban people.

When the rules finally came out this week, they ended up including a provision that allows travelers to stay in private bed-and-breakfasts, like those listed on Airbnb, if they are visiting the island under the “Support for the Cuban People” travel category. A summary sheet of the new regulations says that “renting a room in a private Cuban residence (casa particular), eating at privately owned Cuban restaurants (paladares), and shopping at privately owned stores run by self-employed Cubans (cuentapropistas)” can now count towards supporting the Cuban people. However, a traveler must engage in additional Support for the Cuban People activities — such as humanitarian purposes and human rights assistance — in order to meet the requirements of a full-time schedule. Still, the language was welcome news for Airbnb and the private bed-and-breakfasts that use the travel-booking site and even Cuba hard-liners in Congress said it was something they could swallow. “I don’t have a problem with that,” Rep. Mario Diaz-Balart (R-Fla.) told The Hill.