Troika To Negotiate Settlement Of Certified Claims Against Cuba?

Kushner, Greenblatt & Feinberg

The Process: Briefings, Lunch, Travel

It’s Primarily About Real Estate; So Why Not Use Real Estate Executives?

Two Largest Claims Account For 24%; Thirty Account For 56% Of Total

President Trump Can Negotiate A Deal That Eluded Eleven Of His Predecessors

Settlement Is Possible Without Cuba Putting Up Cash

Every Country Cuba Owes Will Benefit From A Settlement

EU Should Be Advocating For A Swift Agreement

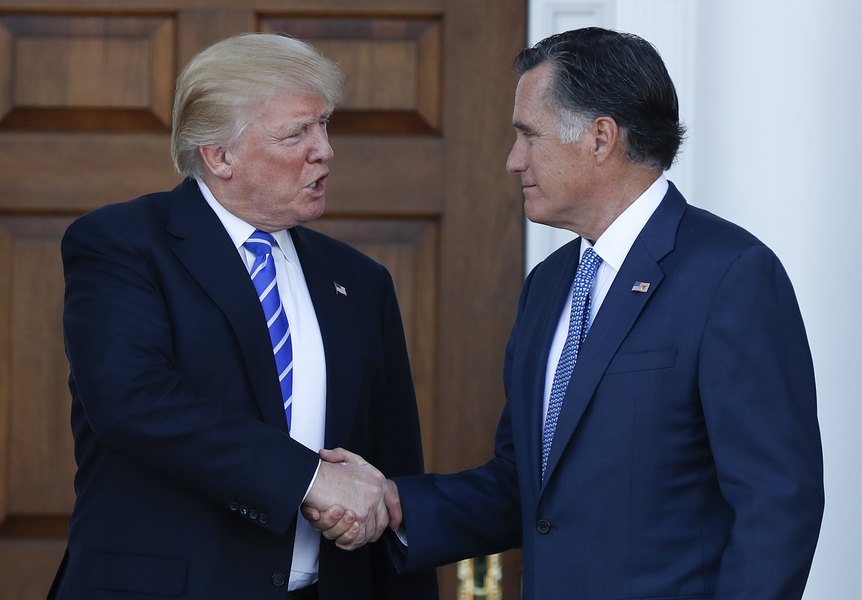

The Trump Administration has created the political moment for tag-team negotiators Mr. Jason Greenblatt (DOB 1967; Assistant to the President and Special Representative for International Negotiations) and Mr. Jared Kushner (DOB 1981; Senior Advisor to the President & Director- Office of American Innovation) to expand their bilateral portfolios to include the Republic of Cuba.

Why Mr. Kushner?

Irrespective of one’s thoughts as to the appropriateness of a role at The White House for the son-in-law of the president of the United States, what matters is the level of confidence by the President of the United States in his son-in-law. Nearing two years into a four-year term, Mr. Kushner retains a prominent presence in Trump Administration.

On 30 November 2018, while at the signing ceremony for the U.S.-Mexico-Canada Agreement (USMCA) in Buenos Aires, Argentina, The Honorable Donald Trump, President of the United States, began his remarks with thanking six (6) people by name; the first was the United States Trade Representative and the second was Mr. Kushner- before the United States Secretary of State, the United States Secretary of the Treasury, Director of the National Trade Council and Director of the National Economic Council.

Prior to the signing ceremony for the USMCA, Mr. Kushner received the highest civilian award, Order of the Aztec Eagle, from the government of Mexico for his work relating to the USMCA. During the presentation, Mr. Kushner shared that his experience working for the USMCA was the equivalent of earning a “PhD in Trade.” President Trump attended the presentation- but the event was not on his public schedule.

At the first meeting of the leaders of the G20 in Buenos Aires, President Trump was accompanied by two individuals: The United States Secretary of the Treasury and Mrs. Ivanka (Trump) Kushner. Not the United States Secretary of State, United States Trade Representative, Director of the National Trade Council or Director of the National Economic Council.

At an evening dinner for leaders of the G20, President and Mrs. Trump were accompanied by Mr. and Mrs. Kushner; and included the couple in official photograph opportunities with H.E. Mauricio Macri, President of Argentina and Mrs. Macri.

On 1 December 2018, Mr. Kushner was a member of the official delegation at the working dinner with President Trump and H.E. Xi Jinping, President of the People’s Republic of China.

On 1 December 2018, Mrs. Kushner was a member of the official United States delegation, accompanying The Honorable Mike Pence, Vice President of the United States, attending the inauguration of the president of Mexico.

On 27 November 2018, H.E. Eduardo Bolsonaro (34 years of age), a two-term member of the National Congress of Brazil and son of the president-elect of Brazil, H.E. Jair Bolsonaro, met with Mr. Kushner at The White House; and departed with a baseball cap with “Trump 2020” printed on the front. According to media reports, the two discussed a plan to relocate the Brazil Embassy in Israel and undisclosed subjects.

The Trump Administration has identified Mr. Kushner as having a significant role in portfolios that include the Middle East, relocating the United States Embassy in Israel, China, Mexico, trade and prison reform among others.

Issue Importance

Senior-level officials within the Trump Administration confirm that resolution of the certified claims, and only the certified claims, is a focus and the United States Department of State, United States Department of the Treasury, United States Department of Commerce, and National Security Council (NSC) at The White House are committed to dedicating necessary resources.

The United States government retains broad discretion to negotiate a settlement on behalf of the claims certified by the United States Foreign Claims Settlement Commission (USFCSC). There exists a highly-motivated pre-positioned constituency among the certified claimants in support of a prompt resolution.

However, identification of the causes for health-related issues impacting United States government personnel located in the city of Havana, Republic of Cuba, remains the primary focus of the Trump Administration and lack of resolution, until which the United States Embassy in Havana will operate at a less than optimal level of personnel, will continue to contaminate all aspects of the bilateral relationship. Within the Trump Administration there exists a confidence that negotiations to resolve the certified claims can develop independent of a resolution to other bilateral issues.

There is bipartisan political party support and bipartisan ideological support within the United States Congress for a robust and sustained effort to obtain a resolution to the certified claims, particularly from those who represent exporters whose expansion of commercial engagement with the Republic of Cuba remains infringed: agricultural commodities, food products and healthcare products and providers of travel-related services.

The Obama Administration deemed resolution of the certified claims was a “top priority,” but had only three (3) discussions (not bilaterally confirmed negotiations) with representatives of the government of the Republic of Cuba in 2,923 days (766 days if calculated from 17 December 2014- the date upon which the United States and the Republic of Cuba announced an intention to re-establish diplomatic relations). During a 20 July 2016 background briefing by a senior official of the United States Department of State:

REPORTER QUESTION (Miami Herald): My question has to do with the property rights issue. I wonder if you could give us any details there. And two, whether Cuba still has outstanding property rights issues with any other countries, and is there a target number we’re looking for, like settling on 20 cents on the dollar, 10 cents on the dollar, whatever?

SENIOR STATE DEPARTMENT OFFICIAL: As I mentioned, property claims is one of our top priorities. We had an initial – or first-round meeting with the Cubans on this issue last December in Havana. We will have a second round of talks here in Washington at the end of this month. We certainly have not laid out any kind of – the details which you’ve described. That will emerge from the negotiations, but we’re committed to pursuing all of the registered claims, as well as other claims that U.S. citizens have against Cuba. So it’s a process. We had a good round last December. We hope to make further progress this month in moving forward on the issue.

The Certified Claims

There are 8,821 claims of which 5,913 awards were certified by the United States Foreign Claims Settlement Commission (USFCSC- https://www.justice.gov/fcsc) at the United States Department of Justice which are valued at US$1,902,202,284.95.

The largest certified claim (Cuban Electric Company) valued at US$267,568,413.62 is controlled by Boca Raton, Florida-based Office Depot, Inc. The second-largest certified claim (International Telephone and Telegraph Co, ITT as Trustee, Starwood Hotels & Resorts Worldwide, Inc.) valued at US$181,808,794.14 is controlled by Bethesda, Maryland-based Marriott International. The smallest certified claim is by Sara W. Fishman in the amount of US$1.00 with reference to the Cuban-Venezuelan Oil Voting Trust.

The two (2) largest certified claims total US$449,377,207.76, representing 24% of the total value of the certified claims. Thirty (30) certified claimants hold 56% of the total value of the certified claims. This concentration of value creates an efficient pathway towards a settlement.

The USFCSC permitted interest to be accrued in the amount of 6% per annum; with the current value of the 5,913 certified claims approximately US$8,521,866,156.95.

“The Foreign Claims Settlement Commission of the United States (FCSC) is a quasi-judicial, independent agency within the Department of Justice which adjudicates claims of U.S. nationals against foreign governments, under specific jurisdiction conferred by Congress, pursuant to international claims settlement agreements, or at the request of the Secretary of State. Funds for payment of the Commission's awards are derived from congressional appropriations, international claims settlements, or liquidation of foreign assets in the United States by the Departments of Justice and the Treasury.”

Certified claimants with current or recent activity within the Republic of Cuba include: New York, New York-based Colgate-Palmolive, Moline, Illinois-based Deere & Company, Atlanta, Georgia-based Delta Air Lines, Boston, Massachusetts-based General Electric, Bethesda, Maryland-based Marriott International, Chicago, Illinois-based University of Chicago, Denver, Colorado-based Western Union and New Haven, Connecticut-based Yale University among others.

Real Estate Experience Helps

The 5,913 certified claims consist primarily of real estate- so who better equipped to negotiate essentially a multi-party real estate deal than two real estate executives? One individual from a multi-generational real estate family. The other a former senior-level executive of a real estate company. Each a hardened negotiator. Each having the confidence of the president of the United States. Each appreciating the focus by the President upon tackling (and resolving) problems left unresolved by predecessors. A fifty-eight (58) year-old unresolved bilateral issue self-defines as a lip-smacking, saliva-creating opportunity for the Trump Administration.

The Trump Administration has less than 800 days during which to identify, commence and complete initiatives that by 12:00 pm on Wednesday on 20 January 2021 will be defined as legacy achievements. The Trump Administration would complete what eleven (11) presidential administrations could not achieve.

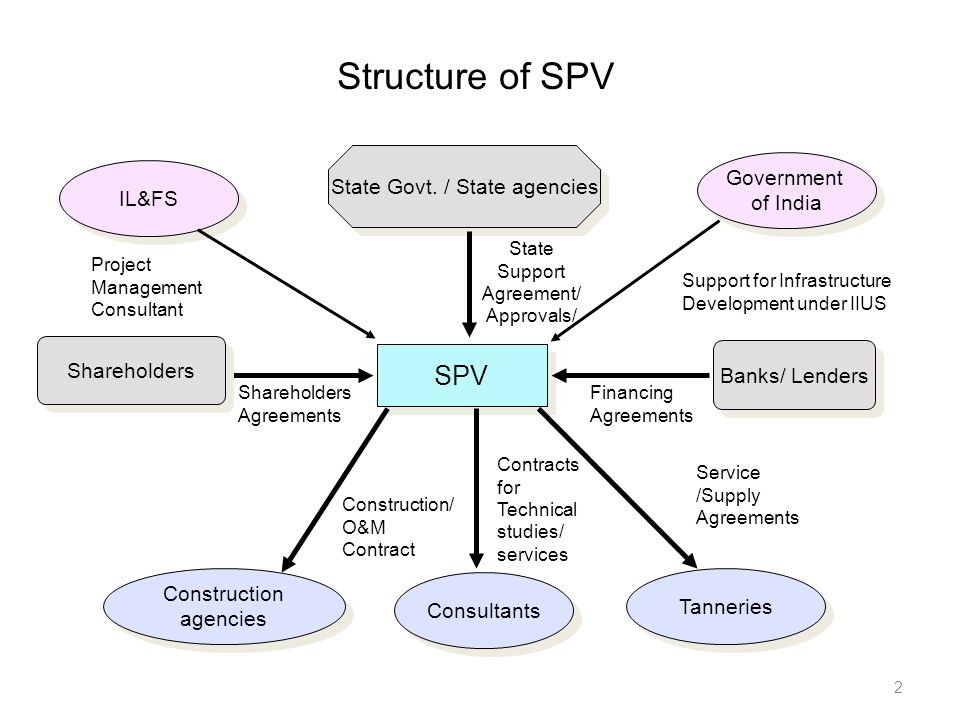

The Day-To-Day Guy

The Kushner/Greenblatt tag-team would become a troika with the addition of Mr. Kenneth Feinberg (DOB 1945), the Washington DC-based attorney (www.feinberglawoffices.com) specializing in mediation and alternative dispute resolution, who served as Special Master for the September 11th Victim Compensation Fund and TARP Executive Compensation; Administrator of the BP Deepwater Horizon Disaster Victim Compensation Fund; retained to assist in the General Motors recall response and compensation for Volkswagen owners. Mr. Feinberg, who could be appointed a Special Envoy, appreciates the singular importance of deadlines. He is positioned to coordinate the day-to-day discussions and negotiations with the government of the Republic of Cuba. Mr. Feinberg has confirmed his interest in assisting with the settlement negotiations.

The troika would be the Trump Administration’s effort to conclude what the Obama Administration failed to do- and what previous occupants of The White House have failed to do on behalf of those 5,913 individuals and companies whose assets were expropriated without compensation by the government of the Republic of Cuba, beginning with an oil refinery owned by White Plains, New York-based Texaco, Inc., now a subsidiary of San Ramon, California-based Chevron Corporation (USFCSC: CU-1331/CU-1332/CU-1333 valued at US$56,196,422.73).

How to begin? A Lunch

The task for Messrs. Kushner, Greenblatt and Feinberg is to directly engage in negotiations with representatives of the government of the Republic of Cuba with the singular goal of obtaining a settlement of the 5,913 individual and company claims against the government of the Republic of Cuba certified by the USFCSC- and only those claims.

First, the troika would convene a series of intimate briefings with representatives of the United States business community, specifically those with certified claims along with their respective legal counsels. As two (2) certified claimants represent 24% of the total value of the certified claims and thirty (30) certified claimants represent 56% of the total value of the certified claims, briefings with each of the primary stakeholders would not be an unreasonable effort to undertake within a thirty (30) day period.

Second, would be an invitation to lunch at The White House extended from the troika to H.E. Jose Ramon Cabanas Rodriguez, Ambassador of the Republic of Cuba to the United States or his successor. The purpose of the lunch would be to establish a personal rapport and create a reasonable and measurable timeline towards resolving the issue of the certified claims; thirty (30) days to create a timeline should be adequate.

Third, would be a visit to the Republic of Cuba by the troika within thirty (30) days of completion of the timeline.

The troika would complete an effort of engagement with the Republic of Cuba awkwardly commenced by Mr. Ben Rhodes, Assistant to the President and Deputy National Security Advisor for Communications at the National Security Council (NSC) during the Obama Administration.

The youthful Mr. Kushner, of reserved demeanor; reared in the oft-described bitter chill of New York City real estate politics, appreciating the role of financial institutions, contracts, loan values, payback periods, incentives, and, most significantly, the development of creative financing packages, would bring a skill set to a bilateral dialogue which has been lacking in successive presidential administrations. Mr. Greenblatt is his perfect partner. Mr. Feinberg brings along the practical experience.

Important that the negotiations have a timeline- a beginning and an end. Six (6) months is more than adequate.

Imperative there be no intermediaries between the governments; no third-parties arranging meetings or serving as couriers for messages. Not a triangle. A straight line of communication. No meetings in third countries.

Structure Of A Resolution

A certified claims settlement should be based upon the payment of 100% of the value of each certified claim. Even with a full settlement based upon principal and interest, the annual rate of inflation has substantially diminished the value of each certified claim.

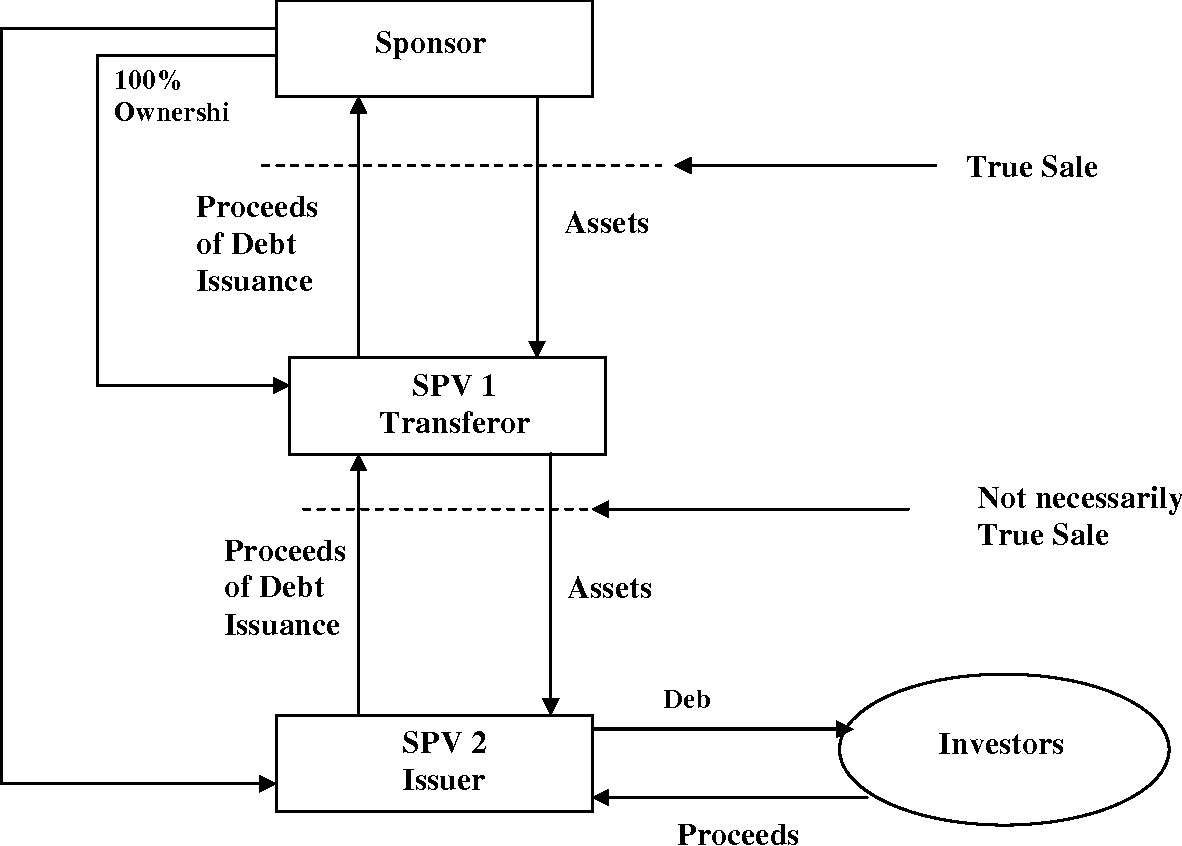

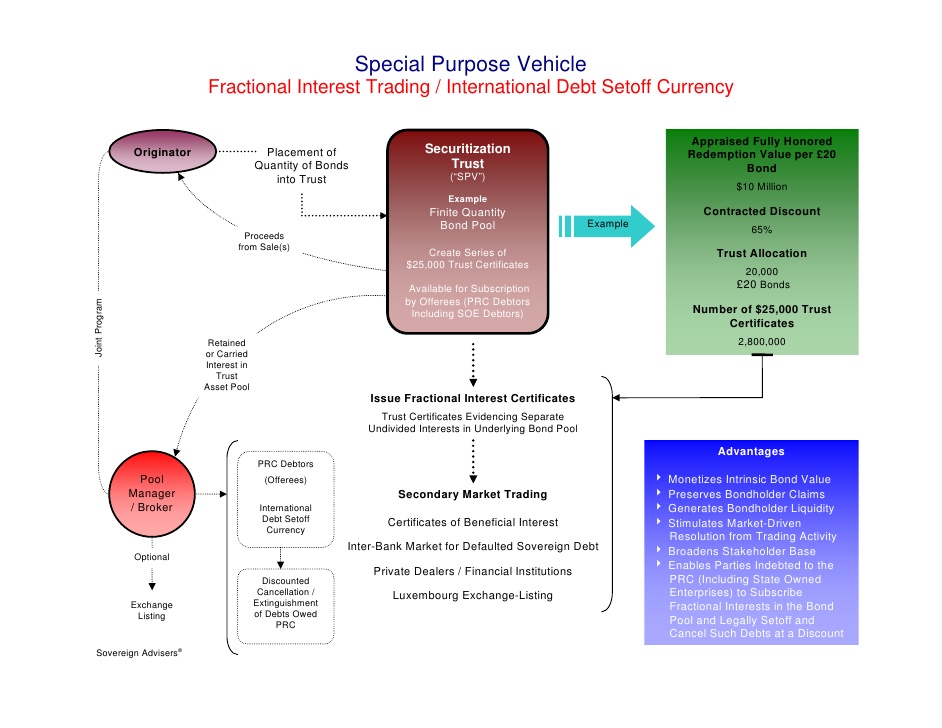

Opportunities for settlement include, but are not limited to, 100% compensation, debt-for-equity swaps and substitution investments (one structure for another; one piece of land for another, etc.).

Portions of monies owed could be transformed into tradable equity positions which a certified claimant could use or could redirect or could market to a third-party.

In combination with or separately from compensation formats, the government of the Republic of Cuba could provide transferable values to the certified claimants including:

· Income tax holidays

· Import duty exemptions

· Reduced energy rates

· Property tax credits

· Earned income tax credits

· Issuance of commercial paper

Resolution is the means to the goal in whatever form such resolutions may take for the largest United States corporate claimants (e.g. debt-for-equity swaps for new direct foreign investment opportunities, or property restitution combined with re-investment in once-owned properties, or the sale of development rights to third parties, United States-based or non-United States-based). The goal is closure.

Importance For Diaz-Canel Administration

If the Trump Administration unleashed this troika, H.E. Miguel Diaz-Canel, President of the Republic of Cuba, would understandably be required to seriously consider the effort and promptly dedicate members of his team to the negotiations- rather than reply upon holdovers from previous administrations.

Resolving the issue of the certified claims would cement the Trump Administration and the Diaz-Canel Administration firmly into legacy-claiming territory.

Resolving the issue of the certified claims is the foundation for six decades of United States laws, regulations and policies.

A re-normalized bilateral commercial, economic and political relationship would benefit the 11.3 million citizens of the 800-mile archipelago and the approximately two million individuals of Cuban descent residing in the United States, primarily in the State of Florida and State of New Jersey.

For the Diaz-Canel Administration, resolving the issue of the certified claims would materially benefit the governments and the private sectors within those countries who have supported the Republic of Cuba- and in far too many instances, found their loans, rescheduling of loans, commercial credits, government-to-government assistance, and private sector investments habitually subject to multi-year and sometimes multi-decade disappointment. Success in the Republic of Cuba has always strained to obtain enough oxygen to provide for consistent and positive performance.

Not institutionally sustainable, nor fair, for the Republic of Cuba to not seek to resolve the one issue with the United States that most negatively impacts those to whom it owes much: European Union (EU)-member countries, Brazil, China, Mexico, Russia, Venezuela and Vietnam among others.

Without the issue of the certified claims, the United States would be expected to remove much of the onerous, and for the commercial partners of the Republic of Cuba, extraterritorial financial sanctions infrastructure managed by the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury, Bureau of Industry and Security (BIS) of the United States Department of Commerce, and Office of Legal Advisor (OLA) of the United States Department of State.

The OFAC, BIS, and OLA-administered sanctions against the Republic of Cuba inflict collateral damage to countries who directly engage with the Republic of Cuba and to countries which may tangentially engage with the Republic of Cuba. All parties would be jubilant if the Diaz-Canel Administration would negotiate a settlement which resulted in an elimination of the sanctions.

No government should build a long-term strategy of victimization when there exists means to remove a problem. Both the United States and the Republic of Cuba have been guilty of such strategies with respect to their bilateral relationship. The history may not be fair; the process for resolution may feel unjust. Governments need weigh the cost of maintaining political pride against the impact upon their citizens (their shareholders) of not resolving an action taken by the government.

The Republic of Cuba should not need to continue to define success by how much others will provide to it for the maintenance of commercial, economic and political systems which are neither self-sufficient nor sustainable. The Republic of Cuba must not be perceived as an exhibit in a museum; and as a symbol of what only functions if others continue to fund it and fuel it.

Resolution of the certified claims will not, on their own, transform the commercial, economic and political infrastructure of the Republic of Cuba. However, it will remove a highly-visible pillar of resistance used to forestall provision of choice, of opportunities to its citizenry.

The government of the Republic of Cuba would wisely accept the advances of the troika for Mr. Kushner, not dissimilar from Mr. Rhodes during the Obama Administration, maintains an intimate working relationship with the President of the United States where the distance between is often immeasurable; and Mr. Kushner has the additional bona fides of proximity due to marriage- which should not be undervalued.

There is in the United States and within other countries an increasing lack of empathy for the Republic of Cuba.

There is a shift of accountability from all that is unsound in the Republic of Cuba is the fault of the United States to its primarily the fault of the Republic of Cuba. A shift from the United States should repair it to the Republic of Cuba should repair it. This dynamic may not be fair, but it is a reality. And successful negotiations are about reality rather than wishful thinking.

For the bilateral relationship with the Republic of Cuba to re-normalize, there must be a resolution of the certified claims; there are no reasons the Trump Administration and Diaz-Canel Administration can’t make it happen during the next 700-plus days.

It’s important to exceed expectations…

LINK TO ANALYSIS IN PDF FORMAT

LINK TO CERTIFIED CLAIMS LIST

Posts About Certified Claims & Trump Administration:

31 August 2018

https://www.cubatrade.org/blog/2018/8/29/ouktsdg4gyrblq7zudchikvdd6abdo?rq=certified%20claims

14 June 2018

https://www.cubatrade.org/blog/2018/6/14/trump-administration-may-be-focusing-upon-certified-claims-unlike-obama-administration?rq=certified%20claims

17 July 2017

https://www.cubatrade.org/blog/2017/7/11/memo-from-nsc-to-potus-this-week-for-title-iii-suspension-capitulate-incapacitate-or-negotiate?rq=certified%20claims

29 May 2017

https://www.cubatrade.org/blog/2017/5/29/0t6ts1bv3by20ot3mi9bydvdqv3e86?rq=certified%20claims

1 January 2017

https://www.cubatrade.org/blog/2017/1/12/h2uudthnn6be8hfgxifqsrdo4aqpb0?rq=certified%20claims

1 December 2016

https://www.cubatrade.org/blog/2016/12/1/zigs56x0gme3a9rqg7aecx9vf2gqgk?rq=certified%20claims

13 September 2016

https://www.cubatrade.org/blog/2016/8/6/obama-administration-wont-seek-dismissal-of-civil-judgements-against-cuba-to-help-certified-claimants?rq=certified%20claims