Paris, France-based Bouygues Construction (2018 revenues approximately US$30 billion) Has Substantial Tourism Presence In Cuba; And, Ironically Involved With Miami’s Brickell City Centre & Other Florida Projects.

"Americaribe LLC is a general contractor with offices based in Miami, Florida and Los Angeles, California. We have operated in the U.S. and Caribbean construction market since 2002, delivering large-scale projects such as the iconic Brickell City Centre in Miami and the Waterfront Hotel in Trinidad & Tobago. We currently have operations in Florida, California, the Bahamas, Dominican Republic, Sint Marteen, Grand Cayman and Trinidad and Tobago. As a subsidiary of Bouygues Bâtiment International, a global player in construction with operations in more than 60 countries, Americaribe is able to apply its vast networks and capacity for technical and commercial innovation, cutting-edge engineering skills and expertise in development to offices, hotels, airports, hospitals, schools, housing, exhibition centers, leisure facilities, etc. The goal for Americaribe is to not only bring projects to reality with an outstanding quality, but to bring concepts of innovation all across the industry with its partners, constructing improved lifestyles for the better future. This motto, branching from Bouygues Bâtiment International, is what we paraphrase as "Shared innovation.”"

If A Company Manages A Hotel In Cuba- Could Be Sued

If An Airline Operates At An Airport In Cuba- Could Be Sued

If A Cruise Line Docks Ships In Cuba- Could Be Sued

If An Internet Company Markets Hotels In Cuba- Could Be Sued

If A Company Builds Hotels In Cuba? Safe… Thus Far

2019 Financial Report Results -29 August 2019

In Cuba, Bouygues Construction continued to build hotels in response to demand from the tourism industry on the island and booked a new order in the first half of 2019.

2018 First-Half Financial Report

In the Americas-Caribbean zone, Bouygues Construction operates mainly in the United States and Cuba. In Cuba, the company is building luxury hotel complexes such as Laguna Del Este on Cayo Santa Maria and Mintur International at Varadero. It took orders for three new hotels in Cuba in the first half of 2018.

2018 Registration Document- Business Activities And CSR Full-Year Financial Report

Order intake on international markets came to €8.7 billion, 25% more than in 2017, following the acquisition of AW Edwards and Alpiq Engineering Services (Alpiq InTec and Kraftanlagen Munchen). Orders included the WestConnex tunnel in Australia, a physics laboratory for Cambridge University, three new hotels in Cuba, a project to build an artificial island for the tourism industry in the Bahamas, and the construction of a solar farm in Australia.

2018 sales: €335 million (+46%) The Americas – Caribbean region is growing strongly. Bouygues Construction has a long-term presence in Cuba, where it is a recognised specialist in the construction of turnkey luxury hotel complexes, a growing market because of the steady growth of tourism. In the Bahamas, Bouygues Construction started work on Ocean Cay, a 100-acre artificial island. In the United States, work continued on “Arte by Antonio Citterio”, a luxury residential complex in Florida.

2016 Registration Document- Business Activities And CSR Full-Year Financial Report

Order intake on international markets came to €6,872 million, close to the level in 2015. Orders included civil engineering works for the Hinkley Point C EPR nuclear plant in the UK, the Monaco offshore extension project, a new section of Line 3 of the Cairo metro in Egypt, six hotel complex projects in Cuba, the Les jardins du couchant property development at Nyon and new work packages for the Erlenmatt (Basel) and Greencity (Zurich) eco-neighbourhoods in Switzerland, the Clementi property development in Singapore, University 6 in Turkmenistan, Hounslow Civic Centre in the UK and Joseph Brant Hospital in Ontario, Canada.

There are opportunities in the Americas, especially the United States and Canada, as a result of the stated intention of rebuilding infrastructure, though they are tempered by a risk of greater protectionism. In Cuba, the expanding hotel industry and the need for infrastructure such as airports and port facilities make the country an attractive proposition for Bouygues Construction.

2016 sales: €348 million (-20%) The Americas/Caribbean region is growing strongly. Bouygues Construction has a long-term presence in Cuba, where it is a recognized specialist in the construction of turnkey luxury hotel complexes. The company continued construction work on around a dozen up-market hotel complexes in Havana, on Cayo Santa Maria, Cayo Coco and Cayo Crus and at Varadero, and also took orders for six new hotels in 2016. The number of tourists visiting the island has soared, opening up great prospects for the Cuban hotel industry.

In the United States, Bouygues Construction put the finishing touches to the Brickell City Centre development in Miami, a complex comprising offices, shops, apartments and hotels.

In Cuba, Bouygues Bâtiment International presented its subsidiary in a vocational high school, followed by a job-dating exercise with all the students, leading to the recruitment of 50 site workers.

Measures either to protect biodiversity or to reintroduce species were undertaken at the following projects: the Challenger renovation, Eikenøtt eco-neighbourhood, La Seine Musicale (Boulogne-Billancourt), the Nîmes-Montpellier railway bypass, the Citybox® street lighting system and the Playa San Agustin hotel (Cuba). The latter venture marks the first application of the BiodiverCity label to a non-French project. Bouygues Bâtiment International is furthermore developing learning trails for future tourists. Other projects are currently in the labelling phase.

2015 Registration Document- Business Activities And CSR Full-Year Financial Report

Cuba. After signing two contracts in May to build two hotels, Bouygues Construction completes three new projects concerning the design and construction of three 5-star hotels in Havana, Cayo Santa Maria and on Cayo Cruz island.

The economic situation in the Americas is contrasted, differing very considerably from one country to another. In the United States, growth is mainly sustained by household consumption. Central and Latin America remain very much dependent on economic conditions elsewhere. Canada was affected by the falling oil price. Bouygues Construction subsidiaries mostly operate in the United States, Canada and Cuba, with growth being driven mainly by major amenity, infrastructure and hotel projects.

2015 sales: €434 million (-3%) The Americas/Caribbean region is growing strongly. Bouygues Construction has a long-term presence in Cuba, where it is a recognized specialist in the construction of turnkey luxury hotel complexes. The company continued construction work on up-market hotel complexes on Laguna del Este on Cayo Santa Maria, on Cayo Coco and at Varadero.

It took orders for five hotels, including three 5-star hotels, at Havana, on Cayo Santa Maria and, for the first time, on Cayo Cruz. The number of tourists visiting the island has soared, opening up great prospects for the Cuban hotel industry.

Health and safety policies at Bouygues Construction’s international operations were broadened in scope and gained structure. Safetyawareness weeks were held in all entities. In 2015, a scorecard allowed each unit and major project to assess itself on five key themes in the Safety Act, with an increased weighting assigned to the worksite equipment and methods criterion, which is crucial to safety. These audits have notably led to the creation of full-time safety manager positions in Nigeria, Cuba and Myanmar.

Over one-third of training dispensed concerns workplace health and safety initiatives. Five training centres (Hong Kong, Singapore, Turkmenistan, Poland and Cuba) train locally hired site workers through sessions geared towards actual work situations (e.g. relating to portable tools, formwork, working at heights and personal protective equipment). Two more centres are planned in Myanmar and Thailand.

The BiodiverCity label, a venture of the International Biodiversity & Property Council (IBPC), promotes the incorporation and preservation of biodiversity in urban environments. Bouygues Construction, a founding member of the IBPC, incorporated BiodiverCity into two operations in 2015: the Roubaix Palissy development by Bouygues Bâtiment Nord-Est and Hotel Playa San Agustín- Cayo Las Brujas (for local company Almest) by Bouygues Bâtiment International in Cuba.

2015 Half-Year Review

In the Americas – Caribbean zone, Bouygues Construction operates mainly in Cuba, the United States and Canada. The company has a long-term presence in an integrated partnership in Cuba where it builds luxury hotel complexes, and signed contracts in the first half of the year for the new Hotel Internacional in Varadero and the Hotel Pilar on Cayo Guillermo. In the United States, Bouygues Construction continued work on the Brickell CityCentre development in Miami.

2013 Half-Year Review

Activity in the Americas/Caribbean region continued to grow rapidly. Bouygues Construction has long-term operations in Cuba, where the company started construction work on a series of luxury hotels and took an order for a new hotel complex in the first half of 2013. In the United States, work continued on the Miami port tunnel within the framework of a 35-year public-private partnership. In Canada, the company started work on a set of sporting facilities in Ontario for the 2015 Pan American Games.

2012 Registration Document- Business Activities And CSR Full-Year Financial Report

Americas – Caribbean

The economic situation in the Americas is contrasted, differing very considerably from one country to another. Some markets seem to be riding out the economic storm better than others. Bouygues Construction is involved in major facilities and infrastructure projects in the region (Canada and Cuba).

2012 sales: €414m (up 45%) Bouygues Construction has long-term operations in Cuba, where it is a recognised specialist in the construction of turnkey luxury hotel complexes. In 2012, the company took orders for luxury hotel complexes on Laguna del Este on Cayo Santa Maria and on Cayo Coco.

Abroad, Bouygues Construction contributes to developing the regions where its entities are located. The company benefits local areas by providing direct and indirect employment, knowledge transfers and support for communities. For example, in Cuba, Bouygues Bâtiment International, which employs 100% local labour, has built a school in order to train its foremen (165 site workers have received such training since 2008).

In addition, Bouygues Construction is still exposed to a favourable business environment in some countries or sectors. This applies to the company’s established markets in Asia (Hong Kong and Singapore), but also to Central America (especially Cuba, where a growing tourist industry with good future prospects is fuelling expansion in the hotel business).

2010 Half-Year Review

In the Americas/Caribbean zone (€104 million, up 10%) business is growing rapidly. In Cuba, in the first half of 2010 Bouygues Bâtiment International signed a contract for a major tourist complex around a marina at Varadero. In Canada, after Surrey Hospital, Bouygues Bâtiment International took an order under a PPP4 contract to build headquarters for the Royal Canadian Mounted Police. ETDE's local subsidiary has a 25-year contract to operate the building and provide maintenance. In the United States, Bouygues Travaux Publics has started to build a tunnel for the port of Miami under a 35-year PPP contract.

2009 Half-Year Review

The Americas/Caribbean zone (€94 million, up 38%) is also continuing to grow rapidly. In the first half of the year, Bouygues Bâtiment International concluded its fifteenth hotel construction contract in Cuba.

From The Company’s Internet Site (10 June 2017):

https://www.bouygues.com/en/newsroom/magazine/hotel-revolution-in-cuba/

A 5-star destination

Tourism is booming here, and Bouygues Bâtiment International, a leading partner of the country since 1999, has twenty-two hotel projects underway on the island. A visit to a few takes us from the streets of Havana to the beaches of Cayo Santa Maria.

On this sunny morning in March, tourists wander the narrow, twisting streets between weathered façades in Habana Vieja1.

The drivers of lemon yellow and raspberry red American cars from an earlier era tempt them with offers of a tour around town, and street singers entertain them with traditional ballads. To the delight of these visitors, their clichéd images of Cuba are still very much alive here in the capital.

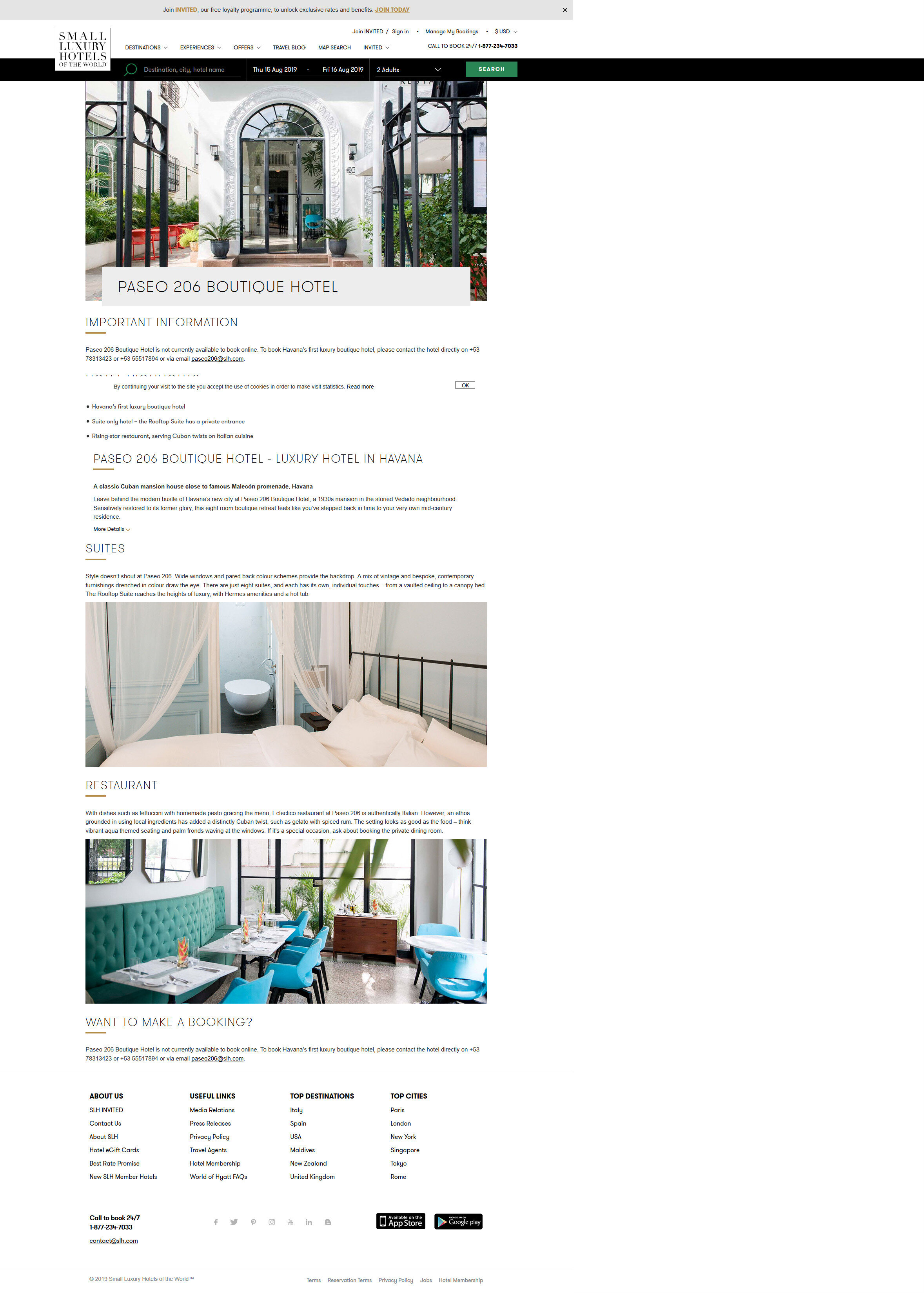

Amidst the hustle and bustle stands Gran Hotel La Manzana with its dazzling white 1900s façade. While workers put the finishing touches on the newly restored building, furniture is hauled into what will soon be Havana’s swankiest hotel.

It is Bouygues Construction’s first hotel in the city. “It is also the island’s first hotel with such high standards and with a style never before seen in Havana,” , says Stéphane Grandperret, Director of the project and of the Havana branch. Teams from Bouygues Bâtiment International have been working on the top-to-bottom renovation project for three years, transforming an old shopping center dating from 1910 into a luxury hotel that will open its doors in 2017

SWIMMING POOLS FLOATING ABOVE THE CITY

All 246 rooms will feature Wi-Fi and smart television, amenities that are important to the international clientele that will stay here. Arno Joubert, a familiar figure in Bouygues’ projects in Cuba, designed the hotel, with a hand from the Bouygues Bâtiment International staff based in Havana. “This hotel will be a benchmark for future ones in Cuba. We had to come up with a design that was classic and age-less, yet still contemporary in spirit.” The predominant color in the rooms, the three bars, and the restaurants is gray, but dashes of color tastefully added here and there remind us that we are in the Caribbean. Providing a final touch of charm to the hotel, the elegant infinity pool on the roof offers a splendid view of the city and the Capitolio building.

Not far from there, over 345 Bouygues workers are busy renovating another hotel from the early twentieth century. The make-over of the Hotel Packard, currently in the structural works phase, presents a technical challenge owing to the building’s combined metal and concrete construction and the eight-meter cantilever above the infinity swimming pool. Seemingly built into the core of the building, this daring pool is the creation of Michel Regembal, the architect of the Stade de France stadium. The Packard will be another standard-setter for five-star hotels in Havana. A particular feature of this project, it is one of eight pilot sites where Bouygues Bâtiment International is applying the lean management approach2. “The planning is participative, collaborative, and visual. Each task is defined down to the smallest detail, which boosts productivity,” explains Project director Manuel Bazan. “One of our missions is to bring these innovations to our Cuban partners.”

30,000 ROOMS HANDED OVER

A six-hour drive from Havana takes us to Cayo Santa Maria. And to a change of scene, with fine-sand beaches replacing the capital’s bustling streets. Nature has been preserved here on one of Cuba’s typical small, low-lying islands to the delight of tourists in search of peace and relaxation. Facing the turquoise sea, a new hotel complex, Laguna del Este 5, is under construction. No fewer than eight cranes tower above the shore, and seven hundred site workers come and go in shifts on this vast project, the tenth that Bouygues Construction has worked on in Cayo Santa Maria.

When completed, Laguna del Este 5 will comprise 802 suites and 34 swimming pools. Procurement is a crucial issue in this project because materials must pass through a Cuban purchasing center, and delivery times vary. “Despite the difficulties, what is motivating here is that each project we do is better than the last in terms of execution,” notes Alexandre Falleguerho, Director of the Cayo Santa Maria branch. “And we also feel we are contributing to the country’s development.” Since 1999, the company has handed over more than 30,000 rooms, or 50 percent of the accommodations offered in Cuba and 100 percent of those in five-star establishments. “Our success here is due to our having listened to the Cubans right from the start. Our collaboration is based on mutual respect,” explains Human Resources director Laurent Mellier. “We spend a lot of time training Cubans and transferring Bouygues expertise to them.”

In recent years, forty-five Minorange Guild members have come from France to manage and train workers on the sites. “We teach them easier ways of working and, most importantly, show them safety best practices,” says Paul Delgado, a Minorange member at Brézillon. “But it works both ways. We learn an enormous amount from them, too.” Demis Monteagudo, the Cuban Deputy director of the Laguna del Este 5 project, agrees: “Our relations are very enriching. Bouygues helps us improve, and the Cuban teams offer solutions that help move the work forward.”

All projects are carried out in joint ventures (AEI in Cuba) that include the Ministry of Construction (Arcos). When an expatriate holds a supervisory position, an identical role is created for a Cuban socio (associate) to foster interaction and training.

IDEAS AND TRUST

In constructing the hotels in Cuba, the company does all the work from A to Z, with no subcontractors. It is a good approach for the teams, as it gets them very involved in the projects. Until the recent jobs in Havana, all the hotels have been at Varadero or on the Cayos. Most offer all-inclusive resort packages to compete with the complexes in Mexico and the Dominican Republic. “We start with a blank sheet,” says Technical director Philippe Trehou. “The client gives us a parcel of land, and we come up with and develop the entire project – the design, construction, and even the landscaping. We have built a relation-ship of trust with Cuban authorities, so we can suggest ideas to them.”

2016: $552 million in order intake and $379 million in sales; 6 Bouygues Construction branches on the island; 11,800 employees and 40% of women in the management committee; 27 nationalities and 54 Maestros de la construcción (Minorange Guild members)

The Bouygues teams track the hotel market closely so they can provide the best advice to their partners. By checking what guests are saying on TripAdvisor, making study trips to other countries, and meeting with hotel operators, they can present projects that are well matched to the demand. “For example, we advised them to diversify and, instead of offering just all-inclusive hotels with over 500 rooms, to also develop smaller, more upscale hotels,” recalls Commercial director Claude Macor. “Our Cuban partners say we are their eyes on the world!”

A new eldorado

It is a partnership that has also allowed a sustainable development approach. “Now all the hotel projects are aiming for BREEAM certification,” points out Izaskun Laucirica, Sustainable development and Quality, Health and Safety manager. Tourism shot up 15 percent in 2016, prompting the government to move forward with a massive hotel construction program. . “Before 2015, we had two or three projects a year on the island, but right now, we have twenty-two projects going all at once,” says Michel Hochet, Head of Bouygues Construction’s operations in Cuba and the Americas. “We are also going to be diversifying, as we are the preferred bidder for the renovation of Havana’s airports. We are also working on many other projects and in particular, tourism-related infrastructures.” Cuba clearly has its sights set on becoming one of the world’s top tourist destinations.

LINK To Complete Analysis In PDF Format

LINK To Libertad Act Lawsuit Statistics