Nine Cuban-Americans In United States Congress

Biden Policies Center-Rights Rather Than Center-Left

Cuba Policy Based Upon Conditionality

Condition Remittance Level Increase To A Non-Military Partner

Whiplash Unlikely At State Department And Department Of The Treasury

Biden Is Not Obama- Restoring Diplomatic Relations Was Done

United States Congress Divisions Will Be 2% To 3%

2022 And 2024 Will Be Relevant

The Biden Administration will not soon return to the United States-Republic of Cuba bilateral commercial, economic, and political landscape that existed prior to 20 January 2017.

The Biden Administration will encounter a larger, less-porous, and media-savvy Congressional Firewall that may limit, perhaps consistently or intermittently during his four-year term, robust re-engagement with the Republic of Cuba.

The 535 members of the 117th United States Congress (House of Representatives and Senate) convene on 3 January 2021.

Potentially interrupting the imperviousness of opposition to Pre-Trump Administration re-engagement would be unilateral and permanent changes implemented by the Republic of Cuba- particularly those relating to its commercial, economic and political infrastructure and, most importantly, lessening its connectivity with the [Nicolas] Maduro Administration in Caracas, Venezuela.

If the Republic of Cuba were to exit Venezuela, the Biden Administration would have a relatively free rein to make changes to Trump Administration decisions relating to the Republic of Cuba. Conditionality would remain, but it would flexible rather than rigid.

The United States House of Representatives will remain in control of the Democratic Party, although with a meaningfully narrower majority- perhaps 2% to 3%. The United States Senate, based upon a bipartisan consensus of analysts, may become a 51-49 majority for the Republican Party after two concurrent elections in the State of Georgia on 5 January 2021.

Nine (9) Cuban-American members of the United States Congress, three (3) in the United States Senate and six (6) in the United States House of Representatives, consisting of two (2) members of the Democratic Party and seven (7) members of the Republican Party, will likely oppose most efforts by the Biden Administration to alter Trump Administration policies impacting the Republic of Cuba and Venezuela.

United States Senate

The Honorable Ted Cruz (R- Texas)

The Honorable Marco Rubio (R- Florida)

The Honorable Robert Menendez (D- New Jersey)

United States House of Representatives

The Honorable Albio Sires (New Jersey; D- 8th)

The Honorable Alex Mooney (West Virginia; R- 2nd)

The Honorable Anthony E. González (Ohio; R- 16th)

The Honorable Mario Díaz-Balart (Florida; R-25th)

The Honorable Carlos Gimenez (Florida; R- 26th)

The Honorable Maria Elvira Salazar (Florida; R- 27th)

Most significant to developing decisions will be the post-election analyses by the Democratic Party and the Republican Party- what were the reasons for President Donald Trump to win the state of Florida, particularly areas located in the southern portions of the state.

The Democratic Party, Biden Administration, presumed Biden/Harris Re-Election Committee, individuals who want to run for office in Florida in 2022, and individuals who want the 2024 Democratic Party presidential nomination should President Joseph Biden choose not to seek the nomination, will not want to take any decision to overtly further disrupt electoral opportunities.

The Biden Administration upon taking office will focus upon the 2022 mid-term elections for the United States Congress, where the political party in control of The White House typically loses seats in each chamber of the United States Congress.

The Biden Administration will be a single term. As such, intra-Democratic Party positioning, particularly within the office of Vice President Kamala Harris, will be disruptive to deciding Republic of Cuba-related decisions as any decision will impact Florida.

The Biden Administration will also be hamstrung by then-candidate Joseph Biden’s statements during the 2020 campaign about the ineffectiveness of Trump Administration policies towards the Republic of Cuba and Venezuela:

“We have to vote for a new Cuba policy as well,” Biden said. “Trump is the worst possible standard-bearer for democracy in places like Cuba, Venezuela, North Korea. Cuba is no closer to freedom and democracy today than it was four years ago. Trump loves to talk tough, but he doesn’t care about the Cuban and Venezuelan people. He won’t even grant Temporary Protected Status to Venezuelans fleeing the oppressive Maduro regime. I will, but we have to vote.” The Miami Herald (29 October 2020)

“Cuba is no closer to freedom and democracy today than it was four years ago.” “President Trump can’t advance democracy and human rights for the Cuban people or the Venezuelan people, for that matter, when he has praised so many autocrats around the world.” The New York Times (29 October 2020)

Despite expectations to the contrary, the Biden Administration will gravitate and navigate an international policy framed by the center-right rather than the center-left. “Human rights” will be the topic sentence when describing policies towards the Republic of Cuba, Venezuela, and Nicaragua among other countries. The debate among policymakers and those who vote in the United States Congress will be how to define “human rights” and how to rank the list of priorities.

The Biden Administration will find a Republic of Cuba again chronically, severely, and negatively self-impacted by its commercial, economic and political decisions which continue to result in a shortage of foreign exchange to make payment for imports, provide inputs to support exports, repay debt, and invest in the redevelopment of infrastructure.

The Biden Administration will also find a Republic of Cuba that continues to recoil from conditionality, from quid pro quo, as it did throughout the Obama Administration and through the Trump Administration. The Republic of Cuba believes it a victim- and thus does not need to do anything to get anything.

The Biden Administration will return to established processes, inter-agency deliberations including career employees and appointees. Impulsiveness will define the Biden Administration. The Republic of Cuba will continue to know, as it did with the Trump Administration, that there will be changes to regulations and changes to policies, but the Biden Administration may provide conditionality with options more easily accepted by the Republic of Cuba.

Outside pressures adding to the less than optimized landscape for the Republic of Cuba include United States statutes, regulations, and policies; the commercial and economic implosion of Venezuela from which the Republic of Cuba has obtained for more than two decades subsidized oil products, loans, grants, and payments for personnel; the impact of the pandemic upon the tourism sector; continued decrease in the number of governments willing to provide financial support to the Republic of Cuba; and lessening tolerance by governments and financial institutions to provide support to the Republic of Cuba when the Republic of Cuba is not implementing permanent structural commercial, economic and political changes which it maintains rather than awaits to undo.

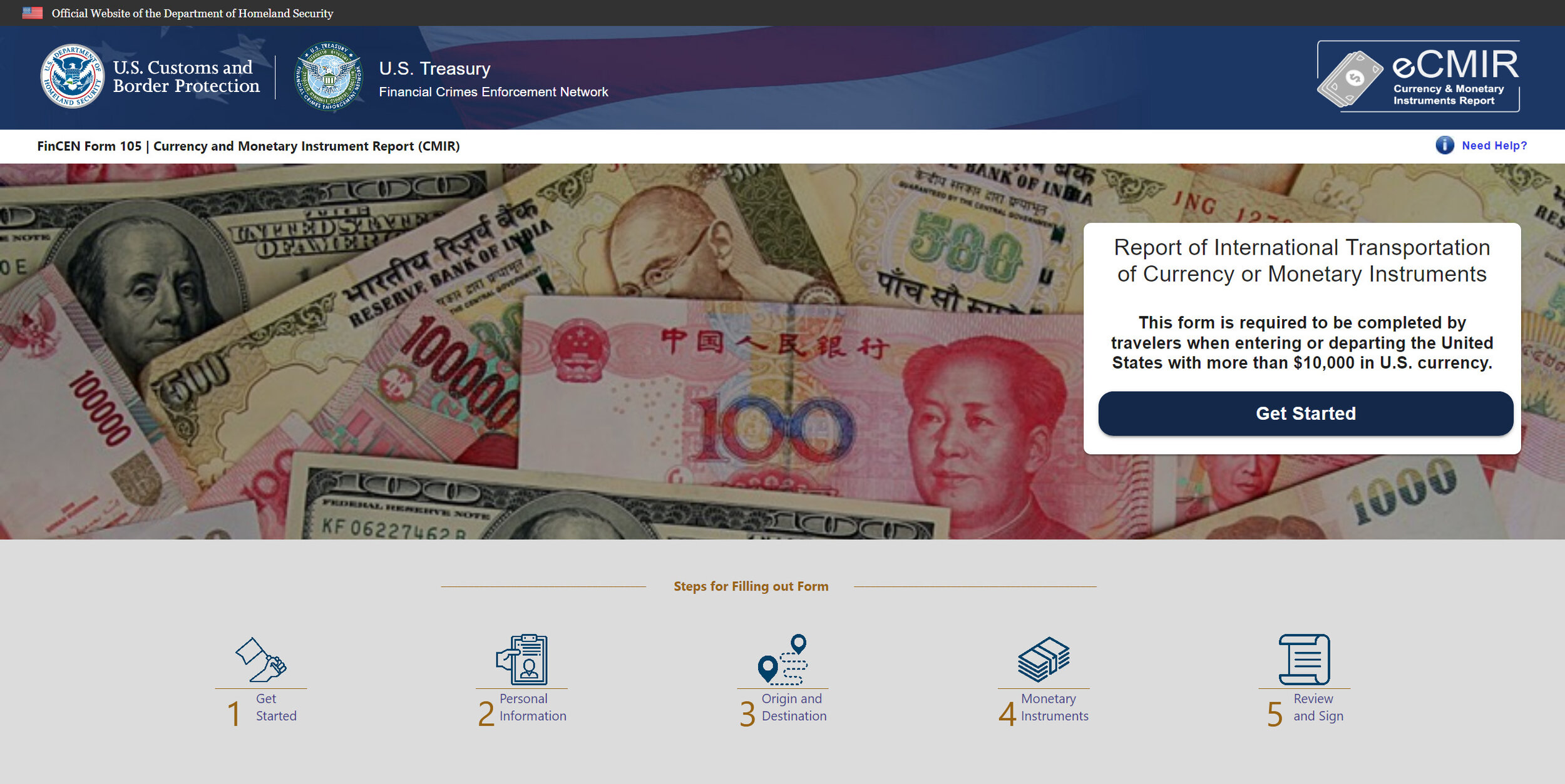

The Biden Administration will likely witness the impact of how the Republic of Cuba implements the cessation of the dual currencies and many currency exchange rates that exist within the country of 11.2 million citizens. The process will be acute- inflicting pain upon most of the population. Remittances from abroad will be important for many to absorb the devaluation of their earnings and savings. The Biden Administration may find an opportunity for leverage by maintaining or changing existing restrictions upon remittances (US$1,000.00 per quarter versus unlimited during the Obama Administration) sent to the Republic of Cuba.

The Biden Administration will also be pressured by members of the United States Congress and particularly by Cuban-American members of the United States Congress to leverage any changes to statutes, regulations and policies impacting the Republic of Cuba with assistance from the Republic of Cuba to develop a pathway for the resolution of commercial, economic, and political issues in Venezuela.

For any cooperation, the Republic of Cuba may require from the United States and Venezuela a multi-year glidepath for decreasing the level of subsidies/discounts provided by Venezuela. One proposal includes a 25% annual reduction of subsidies which would end in 2024 (the end of the current presidential term in Venezuela) when transactions would become market-based. A four-year transition would permit the Republic of Cuba to restructure its energy portfolio while maintaining payment schedules. During this four-year period, the provisions of the bilateral agreement signed with Venezuela in 2000 would remain operational. There is one immensely critical benefit the Biden Administration will have with the Republic of Cuba that the Trump Administration did not have- absence of a lack of trust. Any lack of trust will need be earned.

Will the career employees at the United States Department of State and at the United States Department of the Treasury have whiplash from consequential changes to their “mission set” where they continue to espouse Trump Administration policy decisions until 12:00 pm on Wednesday, 20 January 2021, and then at 12:01 pm on Wednesday, 20 January 2021, they espouse a Biden Administration policy which contradicts what they have enforced and supported during the last four years? Some will.

Biden Administration Do Or Not

· Legislation to demonstrably alter (expand) the commercial, economic, and political relationship with the Republic of Cuba introduced in either chamber of the United States Congress would likely be defeated with bipartisan participation. This is particularly true given the closeness of the Democratic Party-Republican Party divisions in each chamber which may be 2% to 3%.

· Would the Biden Administration eliminate or modify the Cuba Restricted List maintained by the United States Department of State and again permit individuals subject to United States jurisdiction to use hotels and restaurants and other facilities affiliated with the Revolutionary Armed Forces of the Republic of Cuba? Unlikely.

· Resume the operation of cruise lines? Unlikely.

· Renew the license for hotel management contracts? Unlikely.

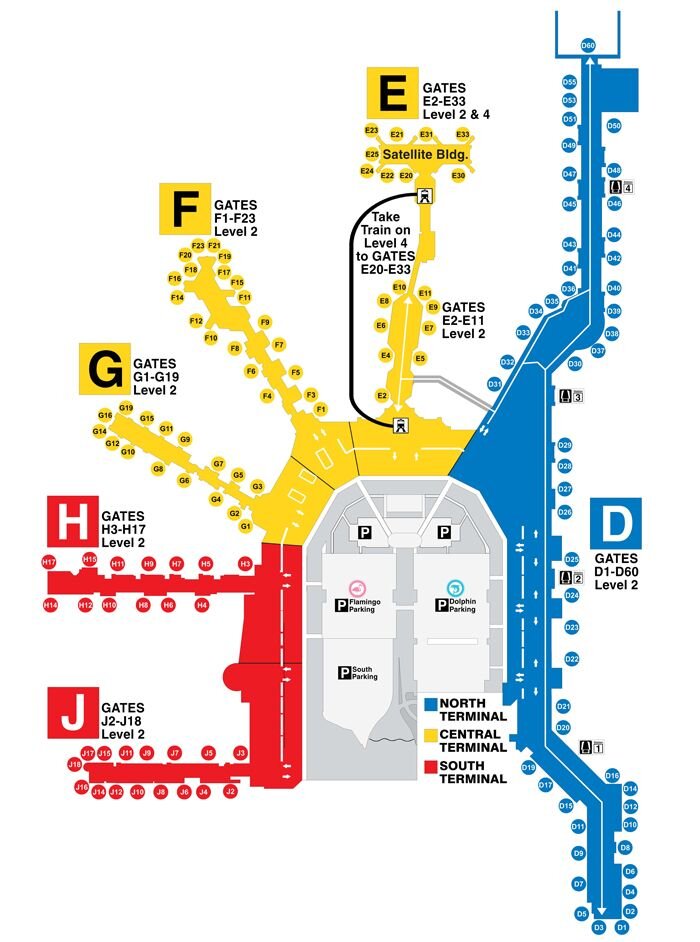

· Re-authorize regularly-scheduled commercial flights to cities other than to Havana? Likely. The flights may be restricted initially to individuals subject to United States jurisdiction who are of Cuban descent visiting family and friends.

· Require the Republic of Cuba to permit United States companies to directly export inputs to any registered self-employed for use in their operations including restaurants, Airbnb residences, and service-focused enterprises. Possible.

· Authorize direct correspondent banking which would permit United States-based financial institutions and Republic of Cuba-based financial institutions to maintain respective accounts so that funds could be electronically transferred transparently and efficiently for use with authorized transactions, particularly supporting the export from the United States of agricultural commodities, food products, healthcare products, and inputs for the self-employed in the Republic of Cuba. Possible. The Obama Administration authorized United States-based financial institutions to have accounts with Republic of Cuba-based financial institutions, but without explanation did not permit Republic of Cuba-based financial institutions to have accounts with United States-based financial institutions.

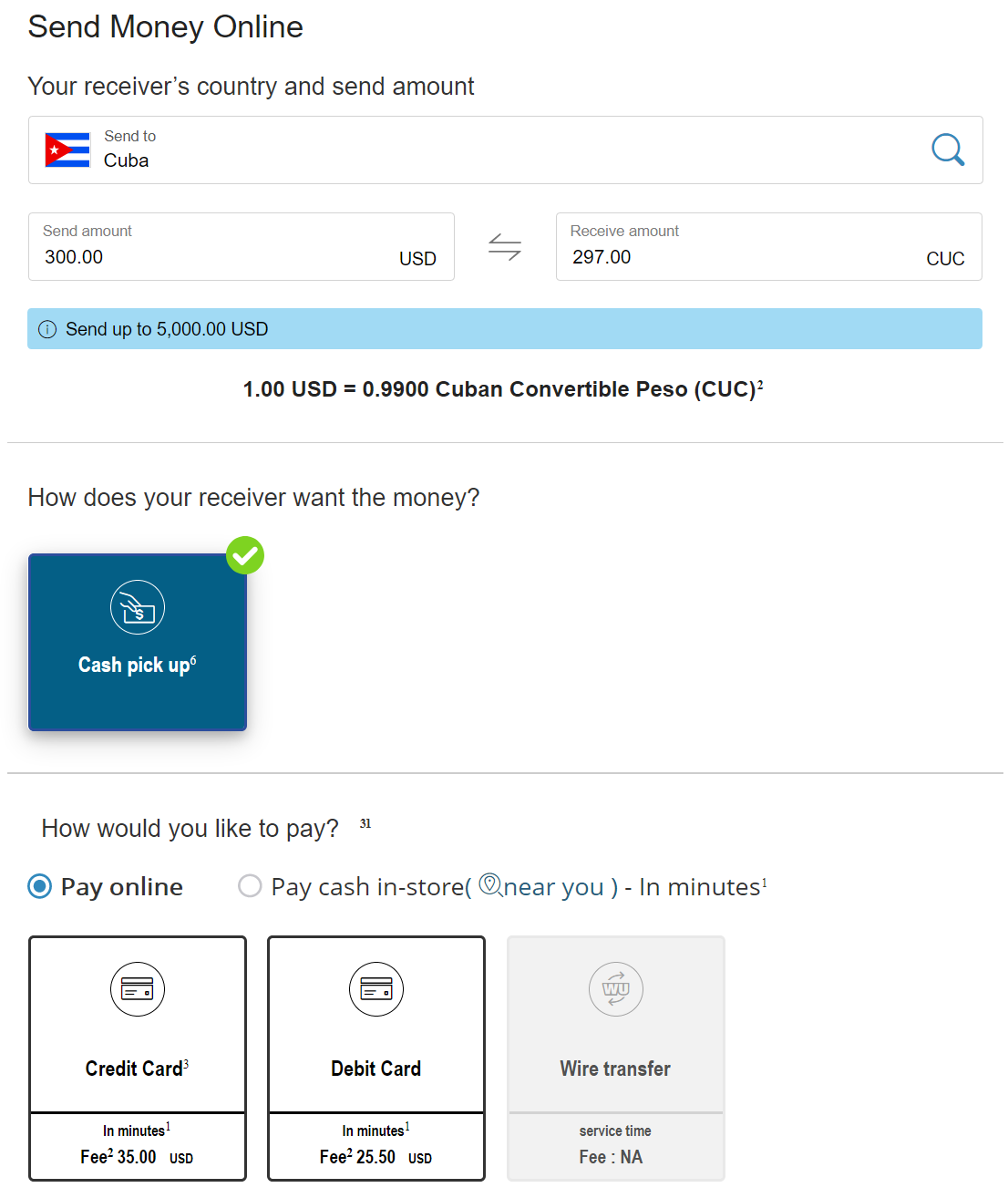

· Increase limits on remittances? Likely. However, unlikely that Western Union will again be permitted to engage with Fincimex as its partner unless it is decoupled from affiliation with the Revolutionary Armed Forces (FAR) of the Republic of Cuba. The Trump Administration has been effective in communicating the rationale for and obtaining support for its efforts to decouple the FAR from its role in the economy. Leadership of United States companies will not publicly oppose a continuation of that policy. The Biden Administration may condition an increase on limits on remittances, or to removing limits entirely, upon the Republic of Cuba separating Fincimex from the FAR. With remittances a critical source of foreign exchange for the Republic of Cuba, the Biden Administration may find success that did not materialize during the Trump Administration.

· Permit expanded opportunities for individuals subject to United States jurisdiction who are not of Cuban descent to travel to the Republic of Cuba? Unlikely initially.

· Add consular staff at the United States Embassy in Havana specifically for the purpose of processing visas. Likely.

· Return to full staffing levels at the United States Embassy in Havana. Unlikely. There remain unanswered questions as to the source(s) of illnesses impacting United States diplomats at the end of the Obama Administration and into the Trump Administration. Many career employees of the United States Department of State oppose any return of staffing levels until the health issues are resolved.

· Appoint a United States Ambassador to The Republic of Cuba. Unlikely initially. If the United States Senate is in control of the Democratic Party, then likelihood increases. Rationale would be that having an Ambassador in Havana, along with the return of a United States Ambassador to Venezuela, may create more useful atmospherics for a resolution of issues.

· Again, suspend Title III of the Cuban Liberty and Democratic Solidarity Act of 1996 (known as “Libertad Act”)? Unlikely. Title III authorizes lawsuits in United States District Courts against companies and individuals who are using a certified claim or non-certified claim where the owner of the certified claim or non-certified claim has not received compensation from the Republic of Cuba or from a third-party who is using (“trafficking”) the asset. A suspension of Title III is unlikely because there is 1) nothing to gain from suspending as the European Union (EU), where most of the non-United States defendants are located, has not taken any meaningful measures, so the Biden Administration would not have a quid pro quo opportunity 2) no compelling reason not to await the final dispositions of the twenty-nine lawsuits filed, some of which have moved to Courts of Appeals 3) as long as Title III is active, it is a bargaining tool for the Biden Administration, so why loose it prematurely 4) there is no meaningful domestic political pressure to re-suspend it and 5) there would be vocal bipartisan opposition by members of the United States Congress.

· Lessen or cease use of Title IV of the Libertad Act that restricts entry into the United States by individuals who have connectivity to unresolved certified claims or non-certified claims in the Republic of Cuba. One Canada-based company and one Spain-based company are currently known to be subject to this provision based upon a certified claim and non-certified claim. Unlikely.

· A re-energized focus upon negotiating a settlement for the certified claims by individuals and companies against the Republic of Cuba, which the Obama Administration did not chose to connect with its regulatory and policy decisions relating to the Republic of Cuba. Likely. There are 8,821 claims of which 5,913 awards valued at US$1,902,202,284.95 were certified by the United States Foreign Claims Settlement Commission (USFCSC) and have not been resolved for sixty years (some assets were officially confiscated in the 1960’s, some in the 1970’s and some in the 1990’s). The USFCSC permitted simple interest (not compound interest) of 6% per annum (approximately US$114,132,137.10); with the approximate current value of the 5,913 certified claims US$8.7 billion. The first asset (along with 382 enterprises the same day) to be expropriated by the Republic of Cuba was an oil refinery on 6 August 1960 owned by White Plains, New York-based Texaco, Inc., now a subsidiary of San Ramon, California-based Chevron Corporation (valued at US$56,196,422.73).

LINK TO COMPLETE TEXT IN PDF FORMAT

Previous Posts:

Cuba Advocates Shouldn't Be So Confident About President Biden

Biden And Harris Discuss Their (Potential) Policies For Cuba... Many Questions Remain. Should Cruise Lines Rejoice?

Former U.S. Secretary Of State Kerry Shares A Biden Administration Approach To Cuba- And Cuba Won't Like It

Biden Criticizes Trump For "Approach" Towards Cuba; Echo Of Kerry Comments Last Month

Does New Charge d’Affaires in Havana Have An Unspoken Goal? Get Thrown Out By 3 November 2020