If Western Union Ends Remittance Services To Cuba, That Means A Return Of “Mules On Steroids”- Impact Could Cripple MIA

Impacting DHS, CBP, TSA, OFAC, FinCEN, Miami-Dade Police Department

Seeking Those With US$10,000.00; Including When Divided Among Travelers

Add 1-2 Minutes Per Passenger Could Result Additional 30+ Hours Of Screening

Might Airlines Decrease Or Decline Services To Cuba?

This scenario could unfold on 22 November 2020 at Miami International Airport (MIA) as the months of November, December and January have an increase in passengers traveling for the holidays:

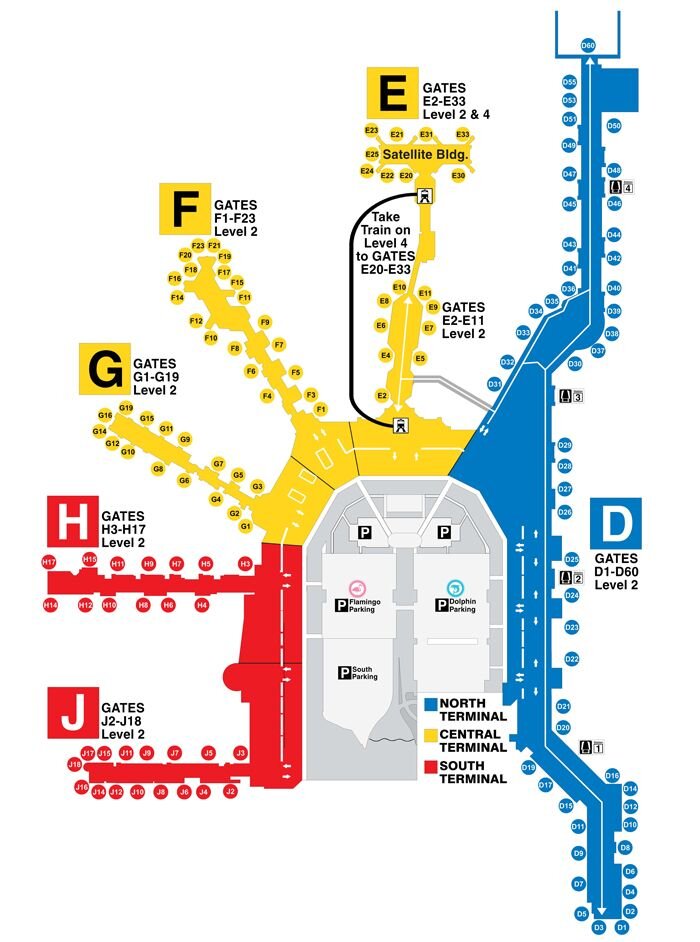

There are twelve (12) flights depart throughout the day to Jose Marti International Airport (HAV) from Concourses D, E and J, for a total of approximately 1,800 passengers.

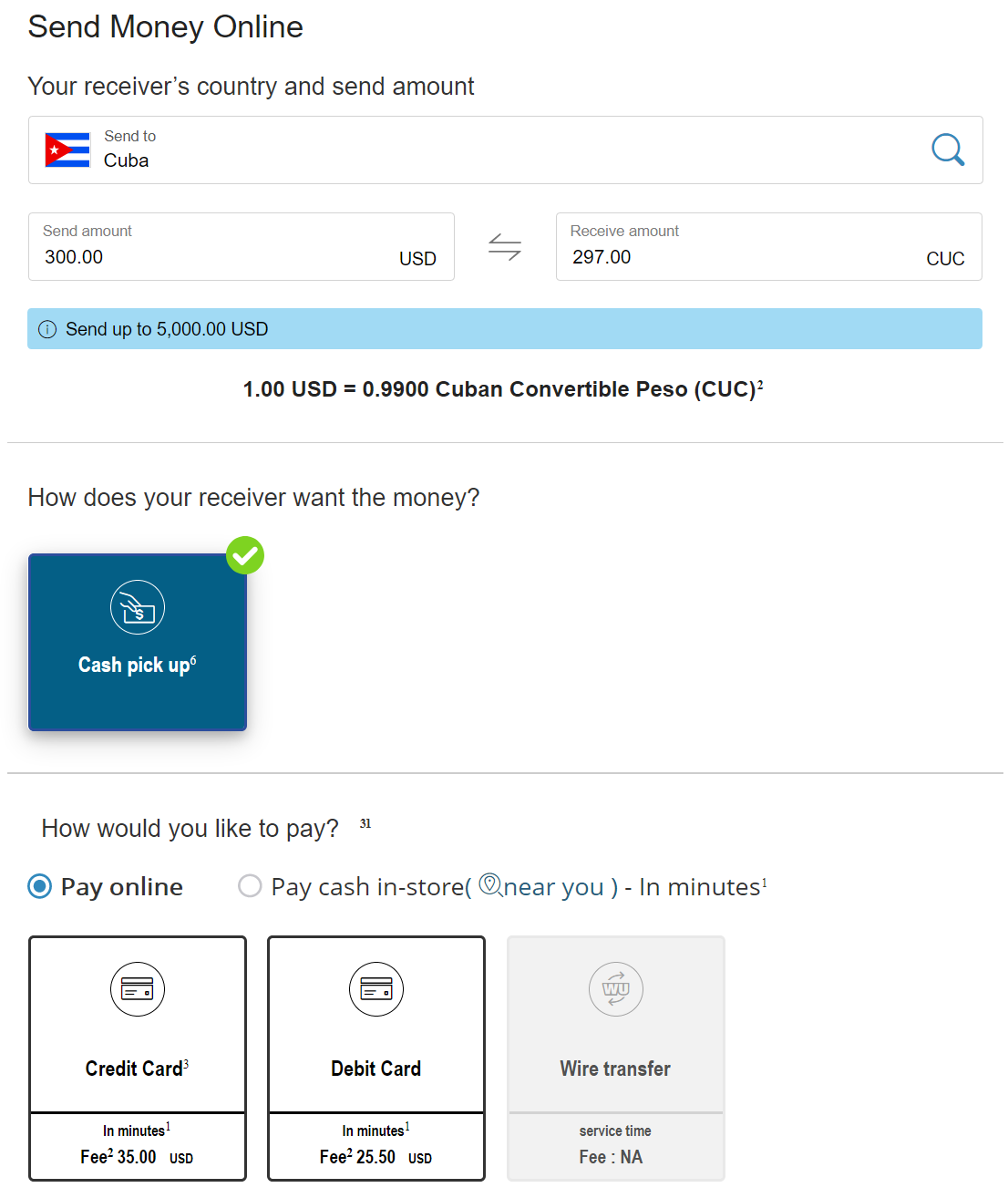

Because Denver, Colorado-based Western Union Company no longer provides electronic remittance services from the United States to the Republic of Cuba, what was the norm more than twenty years ago has returned- individual passengers serving as “mules” to carry onboard (with lesser amounts in checked luggage) United States currency, for a fee, to their families, friends, colleagues, acquaintances, and customers in the Republic of Cuba. The “mules” can often carry US$10,000.00 or more.

A result of the electronic remittance disruption could be an increase in airport security line wait times as secondary-screening for each passenger becomes more likely. One possibility would be a separate security line for passengers at all airports with services to the Republic of Cuba.

The 1,800 passengers traveling on a typical day from MIA to HAV could require one minute to two minutes of additional screening- that is 1,800 minutes to 3,600 minutes per day. There are sixty minutes in an hour. That means an overall increase in screening time of 30 hours or more.

This increase in screening times for passengers on flights to Republic of Cuba then also impacts passengers using the same concourses who are not traveling to the Republic of Cuba. For other airports with services to the Republic of Cuba, they would encounter similar, though less impactful operational obstacles.

The operational disruptions will impact members of the Washington, DC-based Airlines for America, the organization representing the ten largest United States air carriers. Unknown is to what extent an increase in “mule” traffic will impact their schedules and budgets. The impact could result in airlines choosing not to provide services to the Republic of Cuba or decrease services to the Republic of Cuba if airlines are unable to consistently schedule departures and arrivals.

Previously, most flights to the Republic of Cuba operated from MIA. There were additional flights from Boston Logan International Airport, Fort Lauderdale-Hollywood International Airport, George Bush Intercontinental Airport (Houston), Hartsfield-Jackson Atlanta International Airport, John F. Kennedy International Airport, Newark Liberty International Airport, and Tampa International Airport. Airlines operating schedules have included American Airlines, Delta Air Lines, Jet Blue Airways, Southwest Airlines, and United Airlines.

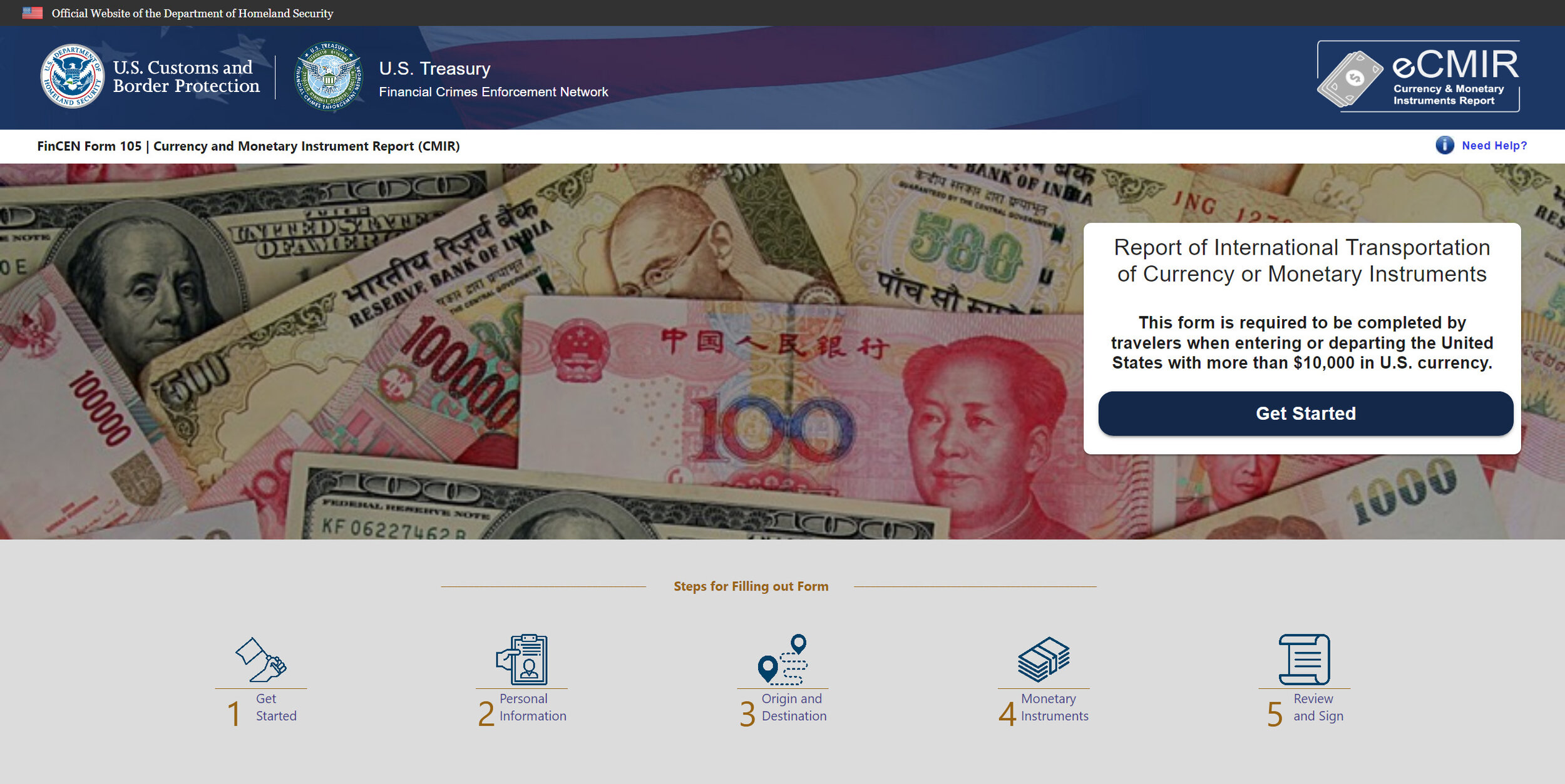

When transporting more than US$10,000.00, a passenger is required to file a report declaring the exact amount of funds to U.S. Customs and Border Protection (CBP) within the U.S. Department of Homeland Security (DHS). An increasing number of United States-based financial institutions have instituted requirements for customers to also file disclosure forms when obtaining less than US$10,000.00 in currency from their bank branch.

Now, officers of the Transportation Security Administration (TSA) who manage the security lanes along with CBP officers might need be detailed specifically to identify violators of DHS/CBP/FinCEN regulations. Screening procedures would include the use of devices and specially-trained canines. There may also be required additional officers from the Airport District Police of the Miami-Dade Police Department to monitor passengers prior to screening as there could be an increase in criminal activities inside and outside of MIA terminals as becomes known that passengers using certain concourses and checking-in for certain flights may be carrying large sums of United States currency.

There may also be required representation at MIA and other airports of the FinCEN (Financial Crimes Enforcement Network) and Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury).

There could be a meaningful impact and upon the already-stressed budgets and already-stressed staffing schedules of the DHS, TSA, CPB, Miami-Dade Police Department, FinCEN, and OFAC.

Cuba Airline Operations

In December 2019, the Trump administration restricted United States regularly-scheduled commercial flights and authorized charter flights to HAV. The decision ended regularly-scheduled flights by Delta Air Lines, Jet Blue Airways, and United Airlines to cities including Camaguey, Holguin, Santa Clara, and Santiago de Cuba.

Regularly-scheduled commercial flights from MIA represent the majority of all regularly-scheduled commercial flights from the United States to the Republic of Cuba.

Regularly-scheduled commercial flight and authorized charter flight passengers departing MIA for HAV primarily use Concourses D (American Airlines), E (American Airlines, Swift Air) and J (Swift Air) at MIA.

After a hiatus due to the impact of COVID-19, HAV resumed its international flight operations on 15 November 2020.

On 4 November 2020, Fort Worth, Texas-based American Airlines reported that three flights daily would operate from MIA to HAV.

Trump Administration Decisions

The Trump Administration prohibits United States-based companies from engagement with entities controlled by the Revolutionary Armed Forces (FAR) of the Republic of Cuba. There is no indication the prohibition will be rescinded or revised. The United States Department of State added to the Cuba Restricted List Republic of Cuba government-operated American International Services (AIS) and Financiera Cimex (Fincimex), a Panama-registered subsidiary of Republic of Cuba government-operated Corporacion Cimex which is a subsidiary of Grupo de Administracion Empresarial S.A. (GAESA) and controlled by the FAR. Fincimex is the distribution partner in the Republic of Cuba for Western Union Company. There is no indication the incoming Biden Administration would make changes to the Cuba Restricted List. The Republic of Cuba continues to evaluate options relating to Fincimex, including the sale or transfer of the subsidiary to a non-FAR-controlled Republic of Cuba government-operated entity, such as a financial institution (Banco de Crédito y Comercio S.A. (BANDEC), Banco Popular de Ahorro S.A. (BPA), Banco Financiero Internacional S.A. (BFI), Banco Internacional de Comercio S.A. (BICSA), and Banco Metropolitano S.A. (BM)) which could seamlessly absorb and maintain Fincimex operations. BICSA has already been vetted by the OFAC and has a correspondent banking relationship with Conway, Arkansas-based Home BancShares through its subsidiary Centennial Bank which in 2017 purchased Pompano Beach, Florida-based Stonegate Bank.

In 2015, the OFAC authorized Stonegate Bank (2017 assets approximately US$2.9 billion) to have an account with BICSA, a member of Republic of Cuba government-operated Grupo Nuevo Banca SA, created by Corporate Charter No. 49 on 29 October 1993 and commenced operation on 3 January 1994.

From Western Union

“We informed our customers they have limited time to send money to their loved ones from the U.S. to Cuba, due to a new U.S. Government rule that will take effect on November 26, 2020. The U.S. Government published the new rule on October 27, 2020, and provided 30 days for technical implementation of the new restrictions. Unfortunately, we have not found a solution in the limited timeframe. The critical deadlines for money transfers to be collected from more than 400 Agent locations in Cuba are outlined below. These deadlines will enable us to pay out transfers in Cuba before the rule takes effect on November 26, 2020. November 22, 2020, at 11:00 PM U.S. EST: The final opportunity to send money from the U.S. to Cuba. November 23, 2020, at 6:00 PM Cuba Time: The deadline to pick up money at Western Union retail agent locations in Cuba.”

U.S. Department of Homeland Security

“There is no limit on the amount of money that can be taken out of or brought into the United States. However, if a person or persons traveling together and filing a joint declaration (CBP Form 6059-B) have more than $10,000 in currency or negotiable monetary instruments, they must fill out a "Report of International Transportation of Currency and Monetary Instruments" FinCEN [Financial Crimes Enforcement Network of the United States Department of the Treasury] United States 105 (former CF 4790). Please be aware, if persons/family members traveling together have more than $10,000, they cannot divide the currency between each other to avoid declaring the currency. For example, if one person is carrying $5,000 and the other has $6,000, they have a total of $11,000 in their possession and must report it on a FinCEN 105 form. If a person or family fails to declare their monetary instruments in amounts more than $10,000 their monetary instrument(s) may be subject to forfeiture and could result in civil and or criminal penalties. The FinCEN 105 form can be obtained prior to traveling or when going through U.S. Customs and Border Protection (CBP). If assistance is required, a CBP officer can help with filling out the form.”

LINK To FinCEN 105 Form

LINK TO COMPLETE POST IN PDF FORMAT